Blogs & Articles: Nic’s 2020 Bitcoin Esoterica Compendium 🔗 3 years ago

- Category: Blogs & Articles | Nic Carter on Medium

- Author(s): Nic Carter

- Published: 13th December 2020 15:15

Nic’s 2020 Bitcoin Esoterica Compendium

Answer key and references for the Very Hard Bitcoin Holiday Quiz

So for this holiday season, instead of talking about all the coins I thought would die, I decided to undertake a brain dump of some of the Bitcoin trivia I’ve picked up over the years. I’ve been accumulating niche and esoteric information about Bitcoin and altcoins for quite a long time now, and it’s time to let it out.

Recently, The Block’s Larry Cermak made a great (and challenging) quiz covering crypto markets to filter prospective interns. I was inspired by this and decided to make an even harder quiz, focusing mostly on half-forgotten moments from Bitcoin’s history. If you haven’t taken the quiz yet, stop reading and take it first:

Nic's Very Hard Bitcoin Holiday Quiz

The first objective for the quiz was to make something that would be extremely challenging, even for the most seasoned Bitcoiner. If you score more than 50% (22 correct), you should be very happy with your performance. It’s meant to be damn hard. Seriously.

The second objective was to remind Bitcoiners of a few entertaining vignettes from Bitcoin’s history. There’s so much amazing stuff that newcomers didn’t have the benefit of living through, and I wanted to dredge some of it up. Bitcoin hasn’t always been an orderly and financialized market. It has been utter chaos for the better part of 12 years. So the quiz was an excuse to resurface some of these wacky tales from earlier days of Bitcoin.

Here I’ll add a bit more context on the questions, and add some references so you can learn a bit more about the events being referenced (and verify that I’m not just making stuff up). Note: the rest of this article spoils the quiz, so do the quiz first before reading.

People

- Before Bitcoin, there was DigiCash. David Chaum infamously turned down a deal that would have put DigiCash in every copy of Windows 95. There’s a great story entitled “How Digicash Blew Everything.” Here’s the key quote:

Earlier Chaum was contacted by the unavoidable Bill Gates of Microsoft. He would integrate ecash in every copy of Windows 95. Rumor had it, the giant from Seattle offered something like 100 million dollars. David Chaum refused to sell it for less than 1 or 2 dollars per sold copy and that stubborn attitude killed another agreement. “A really sad story,” reflects Stofberg. Chaum killed an agreement with another American company, Netscape, in the same way, by insisting straight away that everybody sign non-disclosure agreements, even before negotiations had started. Exit Netscape.

2. Before becoming a Bitcoin Baron with his DCG conglomerate, Barry Silbert ran a company called SecondMarket. They helped make shares in private companies liquid pre-IPO. They were later acquired by Nasdaq Private Market. The Bitcoin Investment Trust, today a gargantuan black hole sucking in all the Bitcoins, has its origins in SecondMarket.

3. So Zooko has really been around the block. He’s been involved in a ton of cypherpunk, p2p, and digital cash projects. Famously, he worked at DigiCash. Mojo Nation is an underrated file-sharing project where he worked with Bram Cohen who would later leave and start Bittorrent. Although Zooko knew the folks at e-Gold, he never worked for them.

4. Another crypto luminary who has worked all over the place is CZ, the founder of Binance. Unknown to many, he worked at Blockchain.info before joining OKCoin where he was CTO. He never worked at Huobi though.

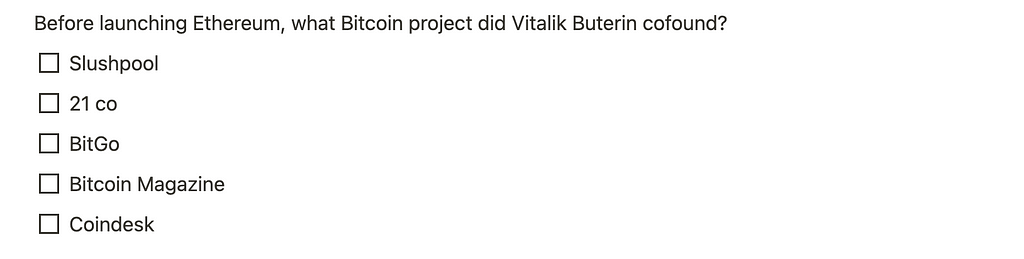

5. This is fairly well known, but Vitalik cofounded Bitcoin Magazine and wrote quite a few articles before starting Ethereum.

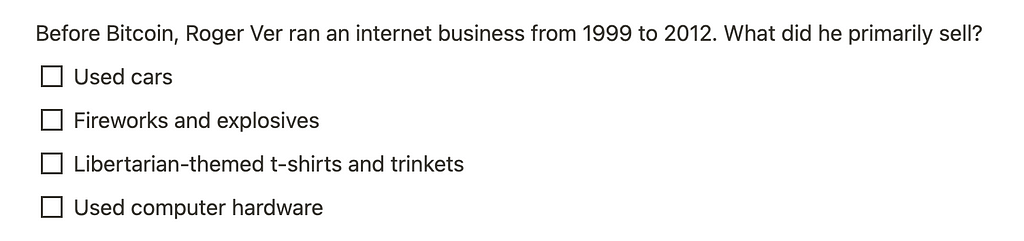

6. If you ever followed Roger Ver on Reddit, you would know him by his handle /u/memorydealers. So what memories was he dealing in exactly? Well memorydealers was a rather pedestrian online shop selling used computer parts. Roger DID briefly sell fireworks (which won him a felony), but that wasn’t his main pursuit.

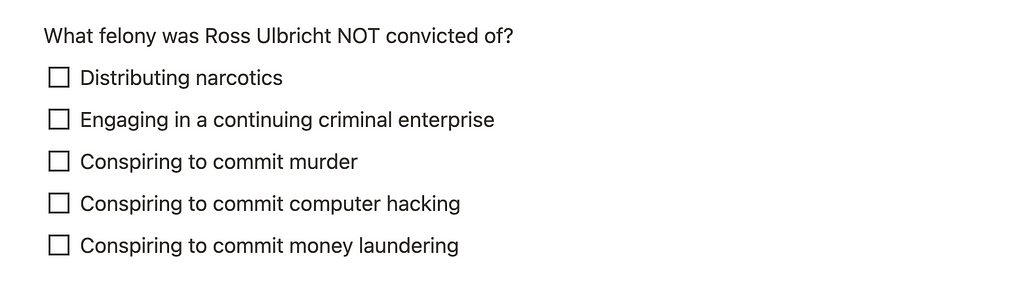

7. Many Bitcoiners will know this one. While Ross Ulbricht got double life for his creation of the Silk Road, the murder-for-hire charges that swirled around the case were never actually included in the final set of charges. In that context, the double life sentence with no parole is more than a little mystifying.

Exchanges

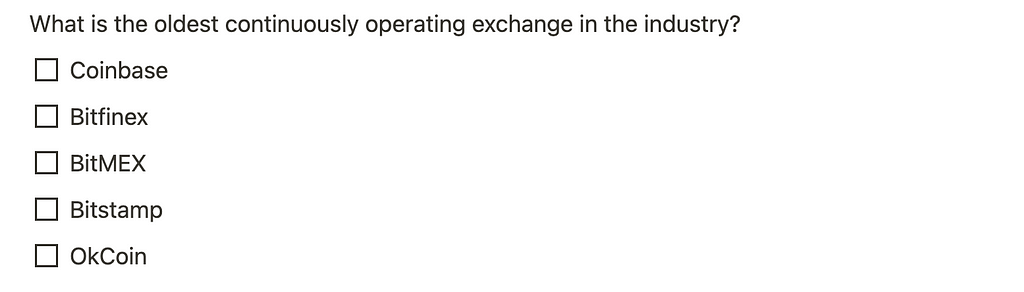

8. The oldest continuously operating orderbook exchange in the entire industry is the Bitstamp, founded in Luxembourg in August 2011. Great job guys! This is why many Bitcoiners refer to Bitstamp prices for continuity’s sake. Although I did get a couple DMs claiming that Tradeogre is actually the longest continually operating Bitcoin exchange. It’s a close one.

9. Ah, Bitcoinica. The genesis of the term ‘Zhou Tonged’. It was horribly run and yet despite — or perhaps, because of this fact — many Bitcoiners remember the derivatives exchange fondly. It was hacked three times. The last time, suspicions abounded about an inside job. In total, around 120k BTC were stolen from the exchange. Where is Zhou Tong today? Who knows.

10. This shouldn’t be too difficult. It’s the last initial of the three original cofounders — Arthur Hayes, Ben Delo, and Sam Reed.

11. Some more Bitcoinica lore. According to Vitalik writing in Bitcoin Magazine, Bitfinex’s original codebase was partly inherited from Bitcoinica, as dysfunctional as it was.

12. While p2p Bitcoin trades took place on various auction sites like Ebay in the early days, as far as I can tell, the earliest continuous, dedicated Bitcoin exchange was Bitcoinmarket.com.

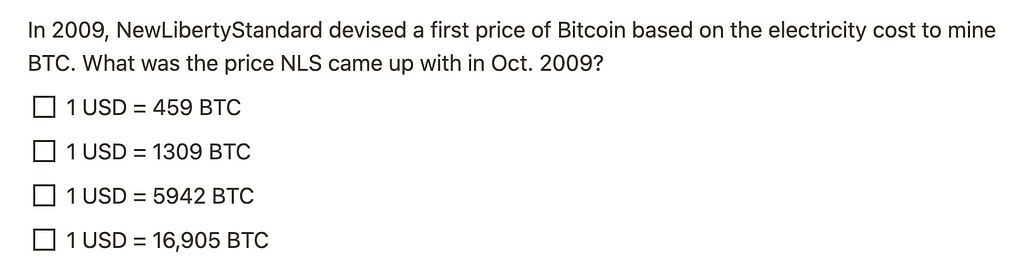

13. This is one of my favorite tidbits. The first Bitcoin ‘price’ was derived by NewLibertyStandard who computed the cost of mining his Bitcoins based on his electricity costs. He derived a unit price of 1 USD = 1309 BTC, or $0.00076 per coin. This was a bit theoretical, because Bitcoin wasn’t meaningfully trading at that time. But I like to think of this as Bitcoin’s first price.

Blockchain

On to my favorite section, weird artifacts found in Bitcoin’s blockchain itself. I owe a lot to Coin Metrics engineer and veritable Blockchain Indiana Jones, Antoine Le Calvez, for some of the findings in this section. He has found some astounding stuff by poring through Bitcoin’s blockchain over the years. Antoine & team share a lot of these hidden gems in the Coin Metrics substack.

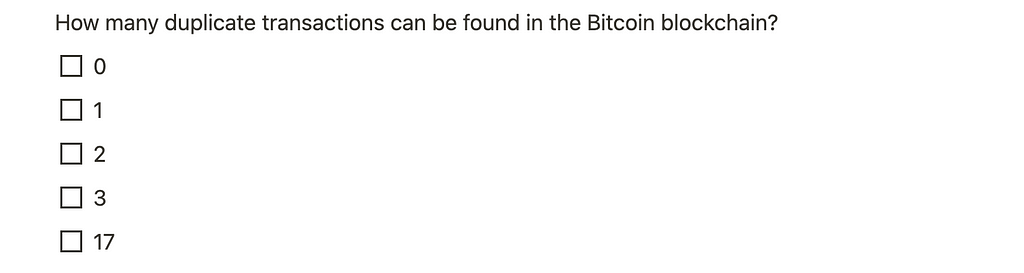

14. Man, I love this damn piece of trivia. This was the first question I wrote for the quiz. The answer is two! There are two instances of identical transactions in Bitcoin:

- Transaction d5d2..8599 was the coinbase output for blocks 91,812 and 91,842

- Transaction e3bf...b468 was the coinbase output for blocks 91,722 and 91,880

This has the practical effect of destroying one UTXO from each transaction. This means that there’s 100 less BTC in existence than you thought there was. Antoine covered the topic masterfully here. There’s no risk of this happening today, due to BIP-34, which required that coinbase transactions include the block height.

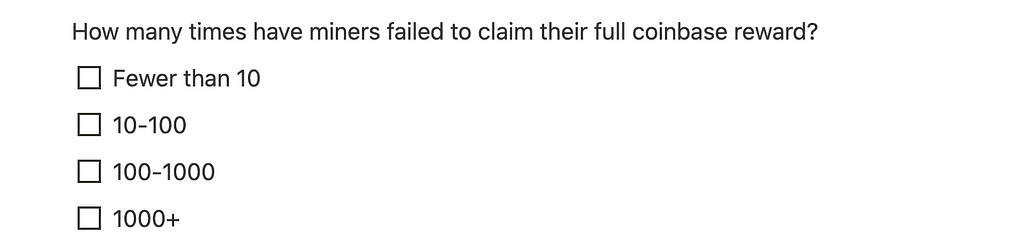

15. Another piece of trivia I absolutely love. As some of you may know, miners don’t have to claim the full coinbase reward. They can award themselves less, if they want to. This means that the designated Bitcoin never actually come into circulation. This means that Bitcoin’s supply is slightly less than what it was intended to be. So far, this has happened 1,221 times. As Antoine says in his piece on the topic:

According to Bitcointalk user midnightmagic, the first instance was done on purpose as a tribute to Satoshi Nakamoto, on a suggestion of Bitcoin developer Matt Corallo. For the other cases, given the amounts lost by some miners, they are most likely attributable to bugs in the software used by miners to create the coin generation transaction.

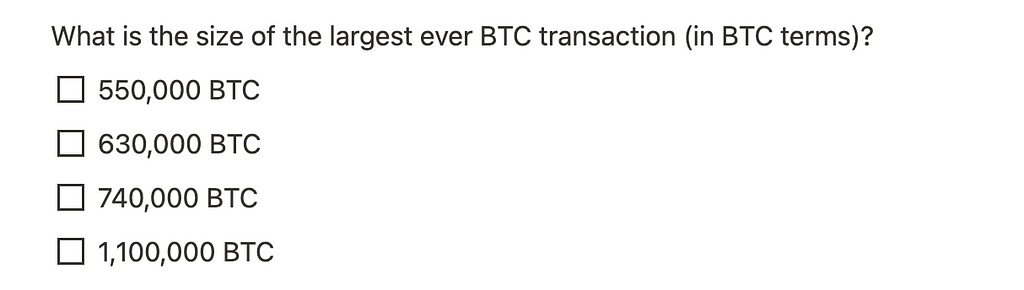

16. Easy one to cheat on if you want! Just go to blockchair and sort transactions by size. The biggest transaction took place in Nov. 2011, outputting 550,000 BTC. At the time, that was worth only $1,265,000.

17. Another one that might be surprising. As some of you know, transactions can bundle together many, many individual transfers. This is called batching. So transactions can bundle up lots of individual UTXOs and output lots of UTXOs, too. The limit is block size. The most input-heavy transactions have 20,000 inputs. Wild. (This is another reason why transaction count isn’t a great way to measure payment activity).

18. If you know a thing or two about LukeJr you can probably guess this one. In 2011, LukeJr’s pool Eligius inserted prayers into Bitcoin. Specifically, he added the divine praises. A few users got fed up and also broadcasted messages on chain admonishing him for it.

19. Most Bitcoiners should know this! It was 184 billion BTC. But don’t worry, that chain was discarded.

20. SatoshiDice was an infamous early usage of Bitcoin, created by Erik Voorhees, whereby you could make bets that would pay out on-chain. It consumed a lot of blockspace in the early days. In 2012 it accounted for a full 40% of all Bitcoin transactions, when counted on a daily basis (although a greater share of some individual blocks).

The Mt Gox Section

Mt Gox is such an incredible, epic, and chaotic story that it deserves its entire section in the quiz. Whole books could be written about the Gox story. I’m surprised there aren’t any yet.

21. Simple enough. Gox opened its doors in July 2010. There’s some disagreement over whether it was the 17th or the 18th. Either way, Gox rapidly became the biggest Bitcoin exchange, and retained that crown until it collapsed spectacularly in 2014.

22. One of my favorite tidbits. Gox was actual insolvent when Jed McCaleb (who later created Stellar) sold it to Mark Karpeles. It’s not clear Gox was ever actually fully reserved. In 2011, skeptical users demanded an informal ‘proof of reserve’ and Gox owner Mark Karpeles conducted a self-send totaling 424,424 BTC, as a sly reference to the Hitchhiker’s Guide. Seriously. Mark was a bit of a peculiar fellow, as you’ll see.

Don’t come after me claiming we have no coins,” Karpeles said, according to a transcript of that online discussion. “42 is the answer.”

23. Another one of my favorite pieces of Bitcoin trivia, period. Karpeles named the Mt Gox parent company after his cat, Tibanne. Tibanne sadly passed away last year. Rest in peace, Tibanne. You were a important cat in Bitcoin history.

24. Because Gox never registered as a money transmitter, DHS shut down their payment processor relationships, and seized funds being held on their behalf by Dwolla.

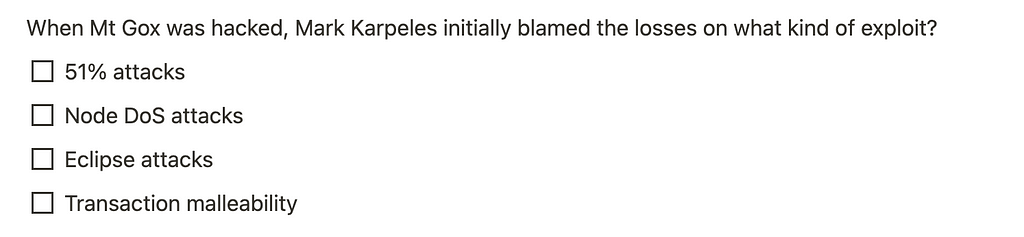

25. So aside from the whole “losing 800,000 BTC” thing, another move Mark Karpeles made that really earned him the ire of Bitcoiners was initially blaming the Gox hack on a Bitcoin protocol-level exploit, known as transaction malleability. In reality, Gox was hacked in a much more straightforward way — hackers simply gained access to cold storage, and siphoned the wallets over a period of years. Wrongly blaming the Bitcoin protocol led to a flurry of Bitcoin headlines about Bitcoin itself being insecure. Not the case: a paper from a team at ETH Zurich found only de minimis losses from malleability, which was never a significant issue on Bitcoin. SegWit subsequently fixed malleability, too.

Altcoins

I get it, this is a Bitcoin quiz. But there’s so much entertaining trivia to do with altcoins, especially early PoW alts. The first few years from 2011 to 2014 were absurd — there was virtually no innovation, just copy pastes of the Bitcoin source code with new names. Let’s dive into the history of alts a little.

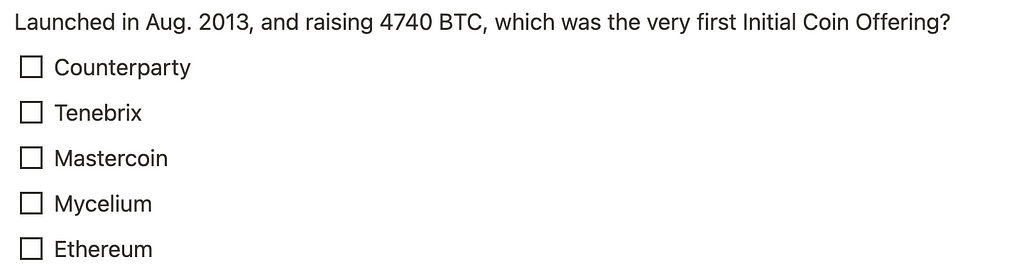

26. So the first ICO was Mastercoin. It really is an amazing story, and I can’t do it justice here. Here’s a fun thread recapping the history. JR Willett devised the idea, imagining ways to extend Bitcoin’s protocol. It later became the Omni protocol, which is what Tether was initially built on. So really, the first ICO was one of the most successful, in that it build something pretty useful for Bitcoiners. That said, the token did not share in the success of the protocol, and is effectively worthless today. Lesson in there!

27. This one is a gimme. The first true altcoin was Namecoin. (Granted, Bitcoin Testnet actually gained a financial value for a second there, and so has a claim to the title of being the first altcoin, too). Originally conceived as BitDNS, and actually discussed by Satoshi on BitcoinTalk, Namecoin was meant to extend the use of Bitcoin as an immutable ledger for domain resolution. Namecoin domains ended with .BIT. As far as I can tell, they don’t really work today. Numerous projects that have taken this idea further since then, including Blockstack, Ethereum’s ENS, Immutable Domains, and Handshake.

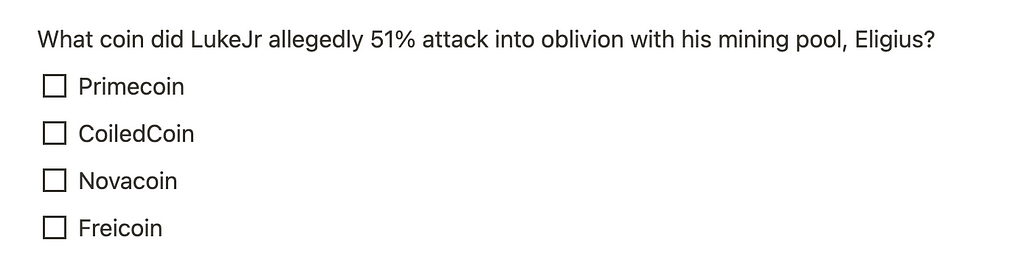

28. So Luke-Jr and his mining pool Eligius appear again in the annals of Bitcoin history. So one thing Luke did aside from posting text to the blockchain, was kill off an altcoin known as CoiledCoin with 51% attacks. (This was one of the hardest questions on the quiz, judging by your responses).

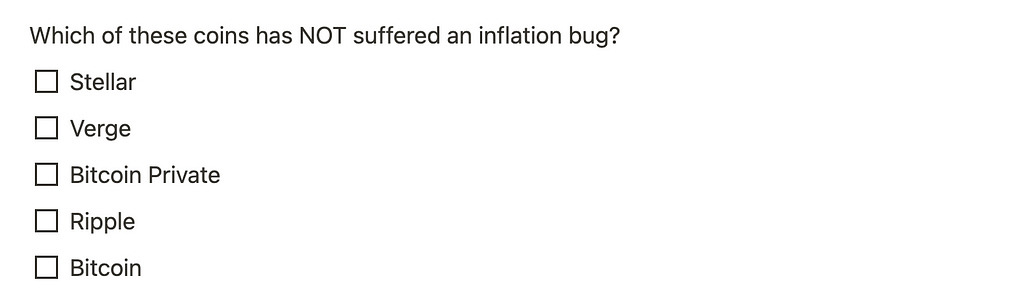

29. So this will trip up a lot of people. The correct answer is actually Ripple. Each of those other coins has suffered an inflation bug — some permanent, some remediated. Many other coins have had inflation bugs too. In fact, look hard enough, and you can probably find unanticipated inflation on almost any public blockchain. I’ll link to coverage of each inflation bug, although each has a fascinating story which is worth diving into (especially Stellar, in my opinion, because they basically concealed it, and never really undid the bug). Auditability matters!

- Stellar

- Verge (Ok I’m going to admit this isn’t strictly an inflation bug, more of an issuance acceleration bug.)

- Bitcoin Private

- Bitcoin

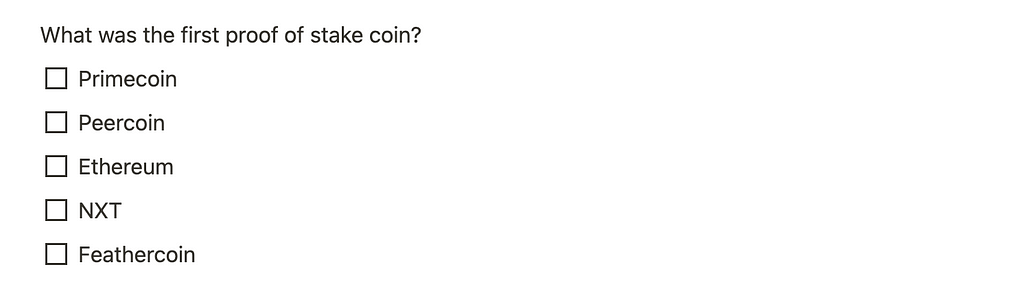

30. Should be easy enough! Launched in Aug. 2012 by the pseudonymous Sunny King, Peercoin was the first proof of stake coin. PoS was meant to be superior to Proof of Work, but like a lot of PoS experiments, it merely introduced new, more complex problems. To solve the nothing at stake problem, Peercoin introduced centralized checkpointing.

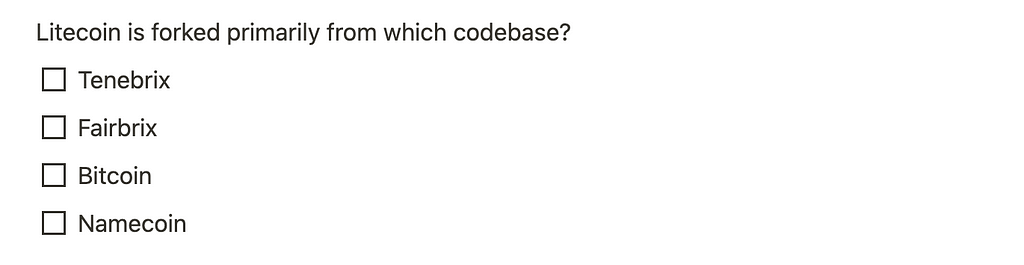

31. So this one is tricky if you know the history. Many people that are familiar with Litecoin’s launch believe it’s a fork of an early PoW altcoin Tenebrix, on account of Litecoin inheriting Tenebrix’ Scrypt hash function (which was meant to be ASIC-resistant). However, the vast majority of Litecoin’s codebase was inherited from Bitcoin, not Tenebrix. (I actually double checked this with Charlie Lee before writing the question.) So, Litecoin — fork of Bitcoin.

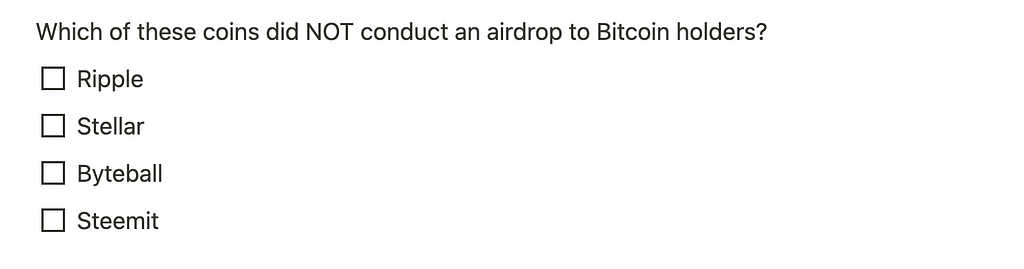

32. Ah, airdrops. They were all the rage from 2013–17. Each of Ripple, Stellar, and Byteball had prolonged airdrop campaigns to try to get Bitcoiners (and others) on board. I don’t think it worked — although Bitcoiners who collected their 2013 1000 XRP airdrop and held on to it saw a nice windfall. (Ok, you can quibble on this, because technically it was an airdrop to BitcoinTalk users, not Bitcoin holders). In this sample, Steem did not conduct airdrops to Bitcoiners.

Miscellaneous

Ok, that’s enough about alts. Back to king corn.

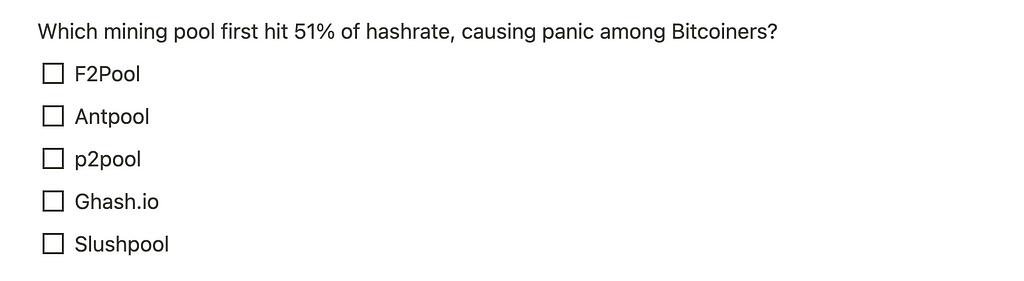

33. Ok, I slipped up on this question. I thought that the first properly documented instance of a pool commanding 51% of BTC hashrate was Ghash.io in June 2014, but it turns out Deepbit was probably first in 2011. Either way, when Ghash gained so much market share, it caused a fair amount of concern. High profile Bitcoin developers like Peter Todd expressed their misgivings about the protocol itself when this happened. Hashrate quickly deserted Ghash after it hit this threshold.

34. Physical bitcoins are incredibly cool Bitcoin artifacts. Casascius coins are physical metal coins with embedded private keys, which cannot be extracted without peeling off a sticker. There’s currently just under 50,000 BTC held in physical Bitcoin format. Because FinCEN warned Mike Caldwell for being a money transmitter, and he stopped selling them, all the Casascius coins that will ever exist have been minted. A collector’s item arguably more scarce than Bitcoin itself.

35. Now this one you will likely only know if you actually bought Casascius coins. (Although some issues of the coins did include the phrase ‘Vires in Numeris’, which tripped a few of you up on this question). The bumper sticker that Mike included with orders read ‘I believe in honest money; gold, silver, and bitcoin’. Those are probably collector’s items now, too.

36. Bitcoin OG’s will remember this one. One of the first big Bitcoin ponzis was the Bitcoin Savings and Trust. Spoiler: it did not save BTC, and it was not trustworthy. Trendon Shavers promised interest of 7% per week. The scheme collapsed in August 2012 and Mr. Shavers was convicted of securities fraud in 2016.

37. One of my favorite pieces of Bitcoin trivia and an incredibly poignant one. Some of the earliest text content in Bitcoin is a tribute left by infosec expert Dan Kaminsky, commemorating his late friend Len Sassaman. He also includes an ASCII portrait of Ben Bernanke, laughing about Bitcoin’s new ‘dependency’ on the former Fed reserve chair. And he spent 1 BTC to do it! See slide 13 here. Full text of the tribute here.

38. Everyone knows that Laszlo made the first BTC transaction by buying pizza. Not everyone knows the details. He bought two Papa John’s pizzas for 10k BTC. And then, reportedly, ran that same transaction three more times. It’s unclear how many times he bought pizza, but his wallet had 80k BTC, so it could have been as many as eight.

39. So here’s another twist in the Laszlo tale. Aside from pizza, we know that Laszlo was one of the pioneers of Bitcoin GPU mining. That’s how he got his hands on so many BTC in the first place. We also know that he was the first to port Bitcoin Core to MacOS. And we know that Satoshi emailed him, asking him not to hoard all the BTC (via GPU mining).

So putting the pieces together, Laszlo might actually be a more complex figure than we initially believed. I think it’s entirely possible that he felt a bit guilty about collecting so much BTC through GPU mining, after Satoshi emailed him, that he decided to effectively distribute his newfound gains into the community via the pizza transactions.

40. Lifetime membership for individuals for the Bitcoin Foundation was a whopping 25 BTC at inception in 2012, although it subsequently declined in BTC terms as Bitcoin appreciated against USD. Quite a few people signed up. Industry membership tiers went up to 10,000 BTC per year. Suffice to say, lifetime members of the Foundation are probably regretting their purchase today. Bitmex Research estimates that the foundation collected 27k BTC in membership dues by spring 2013.

41. In 2013, Bitcoin accidentally underwent a prolonged chainsplit when some node operators upgraded Bitcoin Core to version 0.8, which was incompatible with the 0.7 version. The crisis was resolved by having miners downgrade, allocating hashpower to the 0.7 chain and orphaning the 24 blocks on the 0.8 chain. As it became obvious that the 0.8 chain (which had been as much as 13 blocks ahead) would ultimately be discarded — it was just a matter of time — an opportunity emerged to commit double spends.

And indeed, during this disorderly transition, BitcoinTalk user macbook-air claimed to have successfully double-spent the payment processor OkPay to the tune of $10,000, by making a deposit on the 0.8 chain shortly before it was erased by the miners. While double spends aren’t visible in the final blockchain (because the first double spent transactions are, by definition, not included in the final chain), this was the first documented evidence of the attack taking place.

42. Coin Artist’s awesome puzzle contained the clues to spend 5 BTC held at an address beginning with 1FLAMEN. This is the puzzle. Can you see it?

43. One of Satoshi’s last public pronouncements was a plea to not “kick the hornet’s nest,” at a time when Bitcoiners were considering promoting the cryptocurrency by donating to Wikileaks, which had been the target of deplatforming from traditional payments providers. Satoshi urged Bitcoiners not to garner negative attention by donating to Wikileaks:

No, don’t “bring it on”.

The project needs to grow gradually so the software can be strengthened along the way.

I make this appeal to WikiLeaks not to try to use Bitcoin. Bitcoin is a small beta community in its infancy. You would not stand to get more than pocket change, and the heat you would bring would likely destroy us at this stage.

Bitcoiners were undeterred and donated over 4,000 BTC to the Wikileaks address. That is equivalent to $75m today, although it’s not known whether Wikileaks held on to the BTC or not. (Yes, this is kind of an unfair question, but the quiz isn’t meant to be easy, mmkay?)

44. The Bitcoin Alert System was designed to alert node operators when something was critically awry, like the various chainsplit events we’ve covered in this article. However, it was also a critical point of centralization, because a small number of individuals had the keys to broadcast messages to all nodes running Bitcoin Core. This was clearly a vector for potential abuse, and was done away with in Bitcoin Core 0.13. Satoshi had a key, as did Theymos (the moderator for r/Bitcoin and the BitcoinTalk forum) and Gavin Andresen.

Others may have had Bitcoin Alert keys — it was rumored that Mt Gox had one, which could have fallen into the hands of the Japanese police. Either way, the system was deprecated, and Brian Bishop eventually published the keys, so that no one could benefit from their use.

That about wraps it up. If you get above 50% on the quiz, you should be pleased with yourself. It’s designed to be completely impossible to get a perfect score on. Although a couple people have astonishingly come close. Without having written it, I wouldn’t get a perfect score either — a lot of these facts I had to check sources for and ask experts about. The real point is surfacing some interesting tidbits from Bitcoin’s history, and externalizing this trivia from my brain to the wider world. Happy holidays, God bless, and see you all next year!

I’d like to thank Antoine Le Calvez, Dan Matuszewski, and Dan McArdle for their invaluable assistance and suggestions. It wouldn’t have been half as interesting without them.