Blogs & Articles: Liquidity on Lightning: Moving from UX to Economix 🔗 7 weeks ago

- Category: Blogs & Articles | Breez Technology - Medium

- Author(s): Roy Sheinfeld

- Published: 6th March 2024 13:52

We’ve talked about liquidity on Lightning before, but since Lightning is above all a liquidity network, it bears constant reevaluation. Not only was everybody at Bitcoin Atlantis talking about LSPs, but these conferences are now attracting almost as many financiers as techies. So again I’m compelled to think about value, where it resides, and how Lightning promotes its flow.

The Lightning community has done an excellent job over the last five-ish years of solving liquidity as a technical issue. Remember the days when Lightning users had to first move funds to another on-chain address, open a channel to an obscure Lightning node and spend their sats (where?) before they could even receive their first Lightning payment? We are lightyears beyond those early days. Progress has been massive and relatively fast.

The challenge that remains with regard to liquidity is the economics: how to arrange the broad array of technical solutions into viable business models that benefit users and liquidity providers. In other words, what I’d like to consider here is how to promote Lightning’s continued evolution from a functioning computer network into a thriving financial network.

Constraints and Opportunities for LSPs

Financial networks simply comprise flows of value among actors who are taking advantage of opportunities that arise in a field of constraints. Lightning itself is an opportunity that arose thanks to the constraints of bitcoin. The constraints of how channels and liquidity work on Lightning gave rise to the opportunity of the LSP business model.

Indeed, Lighting Service Providers (LSPs) are to Lightning what airlines are to intercontinental travel. It’s hard to imagine without them. LSPs connect users to the network technically and financially, making sure there is sufficient liquidity to forward payments out into the network as well as inbound back to their users/customers. Thanks to LSPs, users no longer have to worry about channel management, liquidity distribution, or effective routing. All that complexity has shifted from users to the LSPs that serve them.

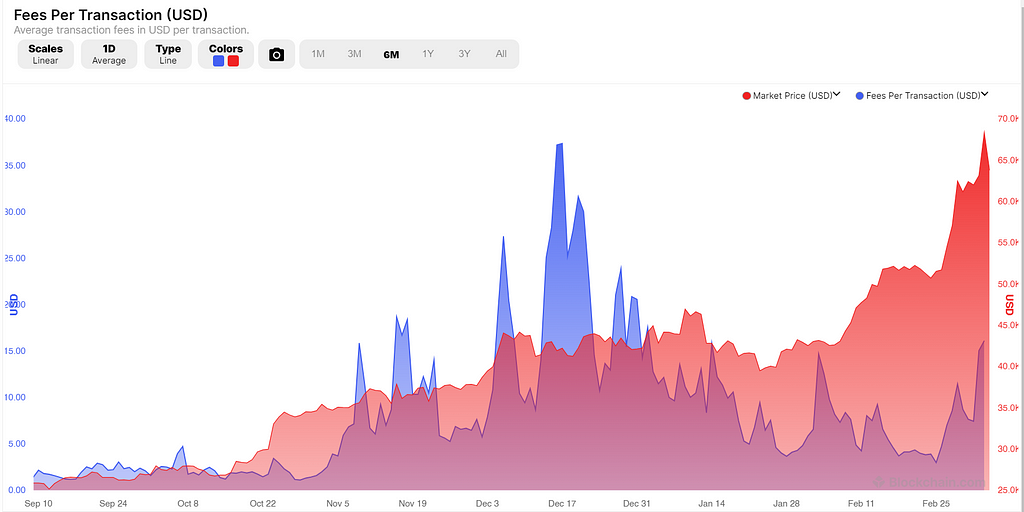

However, LSPs also face some constraints that they can’t simply wish out of existence. The biggest is the cost of on-chain transactions, which are required to open channels. The fees for on-chain transactions are volatile, and there’s little LSPs can do to avoid them. If they forego recording their users’ channels on the chain, then they’re effectively taking possession of their users’ money and becoming banks, catapulting themselves into a whole new galaxy of painful regulation. If they forego splicing out or closing unused channels, then they’re effectively abandoning their own capital locked in those channels.

For LSPs, servers and electricity and lunches are predictable overhead costs, but on-chain transactions are their volatile raw materials, and that’s not even really a metaphor.

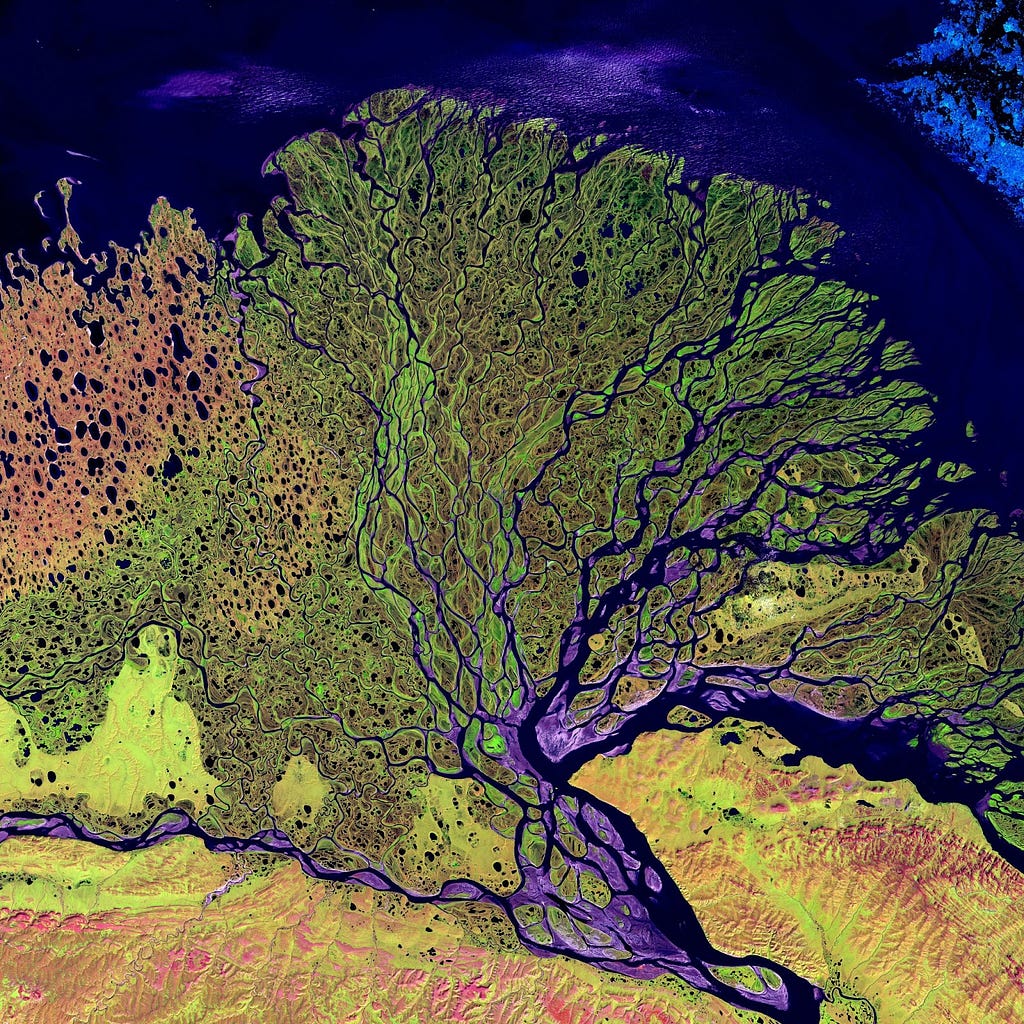

As constraints rise, so do opportunities. (Image: blockchain.com)

As constraints rise, so do opportunities. (Image: blockchain.com)

The raw material of on-chain transactions is an indispensable input to the Lightning business. LSPs add value to that raw material by letting users reuse a single on-chain transaction for an indefinite number of payments (more on that below), which lowers the marginal cost of each payment and increases the efficiency of bitcoin. The service LSPs provide is worth something, and the question is how LSPs can deliver these benefits profitably.

The LTV/CAC ratio is the best indicator of whether an LSP is running a viable business. It divides a customer’s lifetime value to the company (their LTV) by the cost of winning their business (their customer acquisition cost — CAC). If the ratio is more than one, the company is making money on each user, if not necessarily in each week. If the ratio is less than one, the company is losing money on each new customer.

There are many techniques for an LSP to raise its LTV/CAC ratio, but on-chain fees put a ceiling on how high it can go. One easy solution is to pass the cost on to the LSP’s users. For users deliberating between transacting over Lightning or on-chain, this shouldn’t be an issue because the cost of opening a channel amortizes with just a few transactions. When deferring the cost isn’t an option and the CAC can’t go any lower, the only viable option for an LSP is to increase the LTV. That can mean keeping customers as long as possible (by providing good, valuable services) and favoring profitable interactions. Remember how liquidity generates traffic generates ROI generates liquidity? LSPs need profitable traffic from their users in order to give them liquidity and connectivity.

There’s no “one size fits all.” LSPs need to be creative in how they promote profitable traffic (opportunities) in variable fee environments (constraints). For example, if an LSP manages to keep their users around and spending for long enough, maybe they can defer the CAC by treating channel openings as loss leaders.

They can also discourage transactions with low or negative margins. Take zaps. A standard 100-sat zap on nostr is worth about $0.05 USD. A transaction fee of even one cent would be an unreasonable 20%, so LSPs effectively have to process zaps for free. Traffic that doesn’t generate ROI doesn’t generate liquidity, which strains the network unsustainably.

It’s the circle of life: constraints create opportunities create constraints. The market rewards ingenuity.

Now let’s zoom out and consider how these constraints and opportunities aggregate into a bigger picture. What are the constraints and opportunities applicable right now to Lightning as a whole?

Constraints and Opportunities for Lightning

Unsurprisingly, a lot of the early statements about Lightning were gushing with naive promises about how it was going to give bitcoin virtually infinite scale for infinitesimal transaction fees. All opportunities and no constraints.

But you can’t ignore reality for long. Indeed, LSPs are the opportunity that arose from a big initial constraint — the UX. On-chain fees are a constraint that’s not going anywhere, though they affect different users in different ways. Fees of $35/tx can price out an entire continent, but they aren’t even a rounding error to whales who move several btc at a time. As for Lightning, George 203 reminds us that, even if every single on-chain transaction was a new channel opening to onboard a new Lightning user, it would still take too long and cost too much to onboard the planet (how much exactly? do the math). It’s not exactly infinite scale at infinitesimal cost.

So where’s the opportunity for Lightning? In throughput. Check this: in August 2023, Lightning increased Bitcoin’s throughput by 47.2% (according to River’s calculations) with just 0.06% of the transactions: nearly 50% more payment capacity with only 3/5000 of the on-chain transactions! Read that again. Absorb it. Grasp the implications.

Lightning is an extremely effective and efficient tool to move bitcoin. Even if Lightning is no panacea, it is an 833x throughput turbo booster. It’s impossible to imagine the bitcoin economy without Lightning.

These numbers help reconceptualize the place of Lightning in the overall Bitcoin landscape. Let’s push that metaphor a bit and think of Bitcoin as a road network consisting of different kinds of roads and destinations. The blockchain, for example, might be the railroad, which is great for moving large quantities of freight between major hubs, but totally impractical for delivering individual pizzas. Lightning started as a network of freeways, which are faster and more flexible than rail networks but have less carrying capacity. With the help of LSPs, Lightning now covers smaller highways and roads too.

Remember that each trunk road is a tributary for the next level up, and each tributary is a trunk road for the next level down. There are also lonely country lanes, residential streets, bike paths, and even corridors in apartment blocks. None is superfluous, and each optimizes for a different parameter: speed, safety, convenience, minimal equipment, longer or shorter distances, more carrying capacity, etc.

Those parameters define the relevant levels and present opportunities (and constraints). Many of the developments taking place right now around shared UTXOs, federations, and e-cash are trying to innovate last-mile tech in this landscape, responding to current opportunities and constraints. The road/financial network is diversifying internally to make productive use of its liquidity. Though the logics of efficiency, incentives, and viability are universal, Lightning is adapting in countless new ways to local conditions. The network is nothing more and nothing less than the sum of those routes, some new and some well-trodden.

With the right equipment and attitude, there’s no such thing as a bad road. (Image: Éole Wind)

With the right equipment and attitude, there’s no such thing as a bad road. (Image: Éole Wind)

Growth also Means Growing Up

It’s important to remember that constraints aren’t bad. In fact, they’re completely natural. First, the on-chain fees that we see as constraints are what keep the miners in business and help them to keep Bitcoin running. There would be no Lightning without them.

Second, whether to consider something a constraint or an opportunity is often a matter of perspective. The early UX constraints were the LSPs’ opportunity. Bitcoin’s throughput constraints are Lightning’s opportunity. And so on.

Third, accepting and dealing with constraints is a sign of maturation in Lightning and in life. We’re building a revolutionary financial infrastructure that’s upending centuries of centralized, state-based money and finance. Of course it wasn’t going to happen overnight on a network with infinite free, instantaneous payments. Of course it was going to be a revolution of incremental change, with behavior adapting to new conditions and new incentive structures emerging step by step.

Many dramatic changes happen “gradually and then suddenly,” and the transition to the bitcoin economy is still in the “gradually” phase. By building this financial network gradually, overcoming challenges as they arise, strengthening the technical infrastructure as well as the businesses that keep it running, we’ll be ready when the “suddenly” comes.

Liquidity on Lightning: Moving from UX to Economix was originally published in Breez Technology on Medium, where people are continuing the conversation by highlighting and responding to this story.