Blogs & Articles: Setting the record straight on Bloomberg’s stablecoin coverage 🔗 13 weeks ago

- Category: Blogs & Articles | Nic Carter on Medium

- Author(s): Nic Carter

- Published: 29th January 2024 20:12

Do better

Last week, Bloomberg posted an article entitled “Crypto Fans Lured by 20% Stablecoin Yields Even After 2022 Bust” [archive link], which was followed by Matt Levines’ column [archive link] which riffed on the article. Having talked to Hannah Miller for the piece, I was excited to read the article, but I was immediately disappointed at the editorial tilt. I know journalists don’t necessarily write their own headlines, and this sometimes causes the tenor of otherwise-good coverage to end up skewed. Regardless, the coverage, both from Bloomberg’s crypto desk and subsequently Matt Levine sorely misrepresented the issues, and I feel compelled to clarify them.

The Bloomberg article opens with “The same type of investment product that led to widespread disaster in the cryptocurrency market in 2022 is proliferating once again.” Right off the bat, this is false. The authors are referring to the infamous Terra/Luna protocol, whose UST “stablecoin” went from a nominal value of $18b to virtually nothing in spring 2022. The article in question covers tokenized US treasuries /interest bearing stablecoins like Mountain’s USDM or Ondo’s USDY, and Ethena’s USDe. None of those systems bear much resemblance to Terra’s UST.

No one to my knowledge is trying to recreate UST today (nor should anyone in their right mind do it). The uncollateralized UST stablecoin that was backed mainly by Luna — which itself was a pseudoequity derivative of the system — was doomed, and some, including myself, warned about this. For instance, I posted this tweet thread taking aim at Terra on April 21. On May 8th, Terra/UST collapsed.

nic 🌠 carter on Twitter: "of all the bad ideas the crypto industry has come up with algo stables are among the worst / Twitter"

of all the bad ideas the crypto industry has come up with algo stables are among the worst

I also warned about it on my podcast repeatedly prior to the collapse, and directly warned many of my colleagues and friends in the industry. I say this not to pound my chest — I’ve done enough of that — but to be extremely clear that I actually did see Terra coming, I understood the flaws in the system, and I identified the risk before it collapsed. (For a detailed postmortem of Terra/Luna, see my piece All Falls Down coauthored with Allen Farrington.)

At the time, few VCs were willing to speak up about Terra, because many of them were in the trade, or didn’t want to jeopardize the possibility of investing in the Terra ecosystem if it did succeed. (As an aside, this is why virtually no VCs were willing to publicly criticize SBF (as I did), because he controlled the largest pool of capital in crypto at the time). I’ll note that Bloomberg was mainly a cheerleader and stenographer for SBF. And I don’t think they foresaw the failure of Terra either for that matter.

So as we’ll cover here, when Bloomberg implies I’m investing in the next Terra/Luna, they are being unfair in a few ways:

- Most egregiously, implying that all interest-bearing stablecoins have the same risk profile as UST, which was a completely bonkers outlier

- Implying that I lack the ability to evaluate the risk of an interest-bearing stablecoin, when I was one of the few voices that accurately identified the Terra collapse before it happened

- Implying that I am being duped by founders, when it’s in fact me who has been championing the notion of a (responsible) interest-bearing stablecoin for months

If this sounds personal, it’s because it is. Here’s a few passages from the Bloomberg article:

The spectacular implosion of the TerraUSD stablecoin — and the subsequent string of bankruptcies of firms dependent on the nearly 20% yields once offered by a related project — laid bare how risky such investments can be.

Yet memories can be short in the crypto world. […]

As crypto players aim to profit off of the renewed interest in stablecoins, they’ve turned to yield-bearing products that some worry may cause the tokens to be much-less stable than their name implies. These projects, some of which offer interest rates of more than 20%, have raised concern that holders will be stranded with worthless tokens if the mechanics behind them collapse — which was the case with TerraUSD.

The article goes on to quote myself and Martin Carrica, the founder of Mountain Protocol, a company where Castle Island led the seed.

Nowhere in the article do they mention an un- or under-collateralized stablecoin, which UST was. They mention Mountain, Ondo, and Ethena’ USDe. Mountain’s USDM and Ondo’s USDY are fully collateralized stablecoins that simply pass along the interest from the underlying treasuries held in reserve (more detail on Ethena later). This is exactly how the biggest stablecoins work, with the difference being that the issuer passes along most of the interest to holders, rather than keeping it for themselves. This is, obviously, an improvement from an end user perspective. Would you rather keep all your cash in a checking account that pays 0%, or in a money market mutual fund that pays 550 bps? This is the exact same thing, except the issuer liabilities circulate on a public blockchain, as opposed to a bank ledger.

That stablecoins haven’t done this historically is because stablecoin holders could tolerate the lack of yield when rates were low, and there was a high “convenience yield” for cash instruments on chain. Basically, the opportunity cost of forsaken yield was bearable since there were abundant ways to make money with stablecoins with yield farming and so on. However, as crypto rates fell and the treasury rate climbed, capital was sucked out of crypto and back into tradfi (as evidenced by USDC’s declining market cap). This more than anything convinced me that stable issuers would be compelled to externalize yield from their underlying asset portfolio.

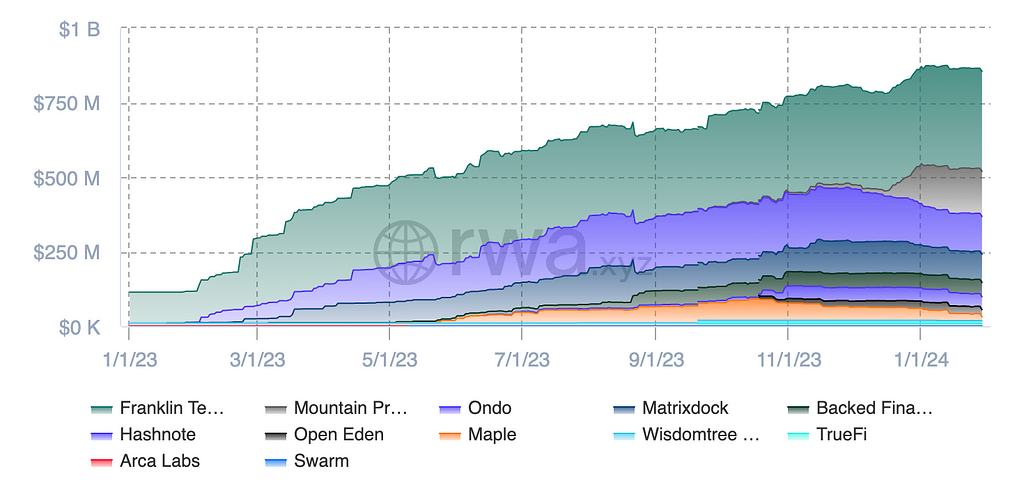

Today, tokenized treasuries total $850m, up from almost nothing at the state of 2023, although not all of them are issued in the stablecoin form factor. But these are all virtually the same kind of instrument.

Tokenized treasuries supply (rwa.xyz)

Tokenized treasuries supply (rwa.xyz)

These are straightforward products. An issuer holds treasuries and they distribute the interest to holders. They differ in terms of regulatory approaches and compliance/permissioning.

It goes without saying that USDM or USDY have nothing in common with UST, aside from the ‘stablecoin’ title (which I’m against anyway, as evidenced by my ill-fated campaign to rename these instruments cryptodollars). If you had asked me, I would have said that Terra’s UST was not a stablecoin at all, but an unbacked liability of the Terra Foundation. Bloomberg is clearly going for gasps when they conflate the two. But the similarities are merely cosmetic.

Mountain passes along 500 bps of interest derived from an underlying Treasury portfolio. UST paid 2000 bps of interest based on Do Kwon’s ability to raise capital.

The risks to something like a USDM are the conventional risks that all stablecoin issuers run: namely, smart contract risks, the (slim) possibility of a liquidity crisis if there’s a run or a problem with a service provider, and the standard regulatory risks. The actual “yield” is derived from holding short-dated Treasury securities. (And by the way, in Mountain’s case, these are held in a FBO Trust which is bankruptcy remote, which is the optimal structure for a stablecoin). If Bloomberg thinks 3-month treasuries are as risky as Terra’s ability to honor an arbitrary 20% rate in perpetuity, they have a very poor opinion of the US government indeed. It’s possible the US government could default. But if it does, we have much bigger problems than the <$1b tokenized treasury sector.

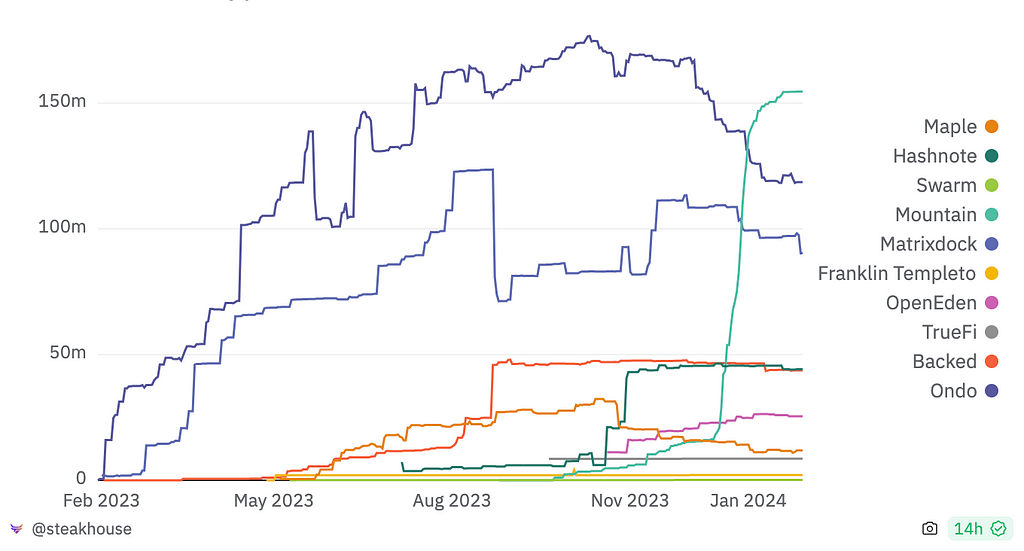

On the other risks, I firmly believe that the Mountain team has appropriately developed processes to manage all of these, and they have my full confidence, which I why I led the round in the first place. The system is working. Today, they are the largest interest-bearing stablecoin, after only a couple months of existence.

Tokenized treasuries / interest-bearing stablecoins (steakhouse)

Tokenized treasuries / interest-bearing stablecoins (steakhouse)

Beyond the incorrect conflation of USDM with Terra’s UST, the article also quotes a purported expert who completely misrepresents the regulatory strategy of Mountain at a minimum. Bloomberg quotes Michael Selig, a biglaw partner, who says:

[Stablecoin issuers] attempt to avoid the registration and licensing requirements by only issuing and redeeming directly offshore, but allowing the stablecoins to flow into the US through secondary sales.

This is just blatantly incorrect. Mountain is a Bermuda company. In fact, they were the first stablecoin licensed with the Bermuda Monetary Authority as a Digital Assets Business. They don’t do business with US clients (based on the Reg S exception, which they judiciously adhere to). So there is no notion of “avoiding registration or licensing requirements”. Last I checked, foreign companies that aren’t based in the US and don’t serve US clients aren’t beholden to the SEC or any other US regulator. Contrary to Selig’s assertion, in no way is Mountain “unregulated”.

The BMA is no fly by night regulator. They are a highly sophisticated, top-tier regulatory body which oversees one third of the global reinsurance market, and has issued digital asset licenses to some of the largest crypto firms on the planet like Circle and Coinbase. According to KnowYourCountry, Bermuda is the 16th ranking jurisdiction globally for AML and sanctions compliance, ahead of the US or the UK.

Contrary to what Selig suggests, Mountain maintains strict protocols that are designed to stop the flow of tokens on the secondary market to US individuals. These include on-chain address monitoring for addresses connected to US persons, off-chain monitoring (including social media, blogs and news), as well as deterrence measures by which holders breaching terms and conditions can have their assets frozen. If a major US exchange were to list USDM, Mountain would explain to them that they are in breach of the T&Cs and, if necessary, freeze the tokens (although I don’t expect it would ever come to that).

And what’s more, an interest-bearing stablecoin isn’t particularly relevant for US individuals, since it’s trivial for an American to get access to a money market fund or a high yielding savings account. This is a product that, definitionally, is useful for someone that doesn’t have direct access to the US financial system.

If Selig or anyone else thinks that Mountain’s registration in Bermuda is tenuous, they just need to listen to Bermuda leadership. Because the US maintains a hostile stance towards stablecoins, dollar stablecoin issuers are going overseas and being welcomed by high-quality regulators like Bermuda, Singapore, or Hong Kong. This evidences the blatant failure of US leadership, but that’s a story for another day.

When I went to Bermuda for their fintech summit last year, the only crypto project Premier Burt mentioned in his remarks was Mountain. The Bermudan regulators are proud that they’re attracting the best fintech/crypto talent with their progressive regulatory regime, and they should be. The US’ utterly shambolic treatment of crypto means that startups and capital will continue to flow abroad, and I’m not at all ashamed of the fact that I’m participating in this exodus.

Tokenized treasuries and interest-bearing stablecoins by domicile

Tokenized treasuries and interest-bearing stablecoins by domicile

Today, most stablecoins (roughly 75%) are crypto-eurodollars, which is to say, they are dollar stablecoins issued offshore. If Selig thinks a dollar stablecoin that doesn’t serve US clients has registration requirements vis a vis the SEC or others, he should identify the law that says that.

On Ethena, it could be the case that Bloomberg was referring to them with the Terra mention, but that’s still an unfair comparison. Ethena is a synthetic USD token which works by combining a long staked ETH position with a short futures position. Staked ETH pays a yield, and short futures normally (but not always) pays a hefty rate (because in crypto markets there’s normally a structurally positive demand for long-biased leverage). The two combined create a delta-neutral USD position which maintains a positive carry. Granted, this is a different flavor of risk than a mere tokenized US treasury, but USDe holders also get a higher yield in exchange for this. And it has vanishingly little in common with Terra’s UST, which offered a completely arbitrary 20% yield based on … nothing. It’s like comparing a high yield credit fund with Madoff’s scheme. And, for what it’s worth, I’ve spent months diligencing the Ethena system and believe it to be extremely well thought-through and very sound — albeit more complex than something like USDM.

Adding fuel to the fire, Bloomberg columnist Matt Levine piled on as well. He quoted the section from his colleagues’ article where I was quoted, and added the following:

Even beyond stablecoins, there is a general category of financial story that is like “somebody convinces venture capitalists that reinventing banking is a good idea,” and those stories often end up in, uh, interesting places. (A lot of fintech stories are that sort of story, but the story of FTX is really that sort of story.) Reinventing banking is a great idea! You can make a lot of money, pretty consistently, by taking risks that your venture capitalists don’t notice. “We’ll take deposits, pay interest, invest the deposits, earn more interest than we pay, keep the spread and not be subject to bank capital or prudential regulation” is a great trade some large portion of the time, surely large enough to raise some venture capital.

This again is quite unfair, and unbecoming for Levine, who is normally excellent. We’re not reinventing banking. Mountain is not “not subject to prudential regulation” (they are regulated as a Digital Asset Business by Bermuda which has a specific expertise and body of work on digital assets dating back years). The “venture capitalists” (aka, me) aren’t ignorant of the risks.

Martin Carrica, the founder of Mountain, didn’t convince me that interest bearing stables are a good idea. I’ve had conviction on the idea for well over a year now (and have looked at many startups in the category). I went on a speaking tour last fall making the case for interest-bearing stables, keynoting Token2049, Messari Mainnet, and Boston Blockchain week, where I gave talks explaining why I think they’re a good idea. I haven’t been duped in any way, and I’m fully apprised of the risks here.

And I don’t think we’re reinventing banking for that matter. We’re merely moving the database tracking the liabilities away from a bank or an asset manager’s back office to the blockchain. There’s particularly nothing new or unusual — at least from a risk perspective — about what tokenized treasury issuers are doing. What’s different is that the liabilities freely circulate on a public global ledger, opening up access to virtually anyone worldwide. I believe to be an unambiguously good thing, and have placed my bets accordingly (in the arena trying stuff, etc.) I believe both Mountain and Ethena have been extremely transparent about the risks, and are going about them in a responsible way — while providing a superior experience to users.

USDe or USDM bear no similarities to UST besides the stablecoin title. They aren’t the same thing at all, and it’s completely irresponsible for a financial journalist to make the conflation.

I’ve talked to Bloomberg journalists, no exaggeration, hundreds of times over the last six years. They have been kind enough to invite me on TV more than a few times. I consider some of their journalists and analysts good friends. And this is why I’m extra disappointed at their recent, very strong, anti-crypto tilt. I expect sophisticated coverage from them, and I know they can do much better than this.

As I have made clear, as discussed in my Messari Mainnet presentation, supporting dollar stablecoins is in the national interest. Stables export the dollar globally, creating strong benefits for the large fraction of the world’s population that struggles with unstable banking systems, weak currencies, and inferior property rights. Interest bearing stables are the next evolution and further enhance the value proposition of these instruments. The journalists that cover these systems would do well to treat them fairly, rather than writing histrionic missives chasing the hobgoblins of yesteryear. We don’t ask for preference or a rose tint: just the truth, and a fair assessment of the risks and benefits of these systems.

Nothing in this piece should be construed as investment advice. Mountain’s USDM is not available to US individuals. CIV disclosures. Personal disclosures.