Blogs & Articles: John Griffin is an academic fabulist 🔗 6 weeks ago

- Category: Blogs & Articles | Nic Carter on Medium

- Author(s): Nic Carter

- Published: 15th March 2024 14:50

And it’s time we do something about it

John Griffin, he of the infamous Griffin and Shams paper which gave academic grist to the Tether Truther crowd, has poked his head up once again. Unsatisfied with spinning vague conspiracies about Tether to undermine Bitcoin, he has now moved on to claiming that the crypto market finances slavery at a mass scale via romance scams. His new paper is just as flawed as his effort with Untethered, and if unchecked, could do a similar amount of damage. This man is a dangerous sophist who hides his weak arguments behind the veil of academia — but leaves a trail of real fallout that affects everyone in crypto. It’s time we scrutinize his record.

As a new industry which is largely derided by the establishment, crypto suffers from the problem of academic truth-laundering. What happens is that some anti-crypto academic out to make a name for himself publishes a questionable critical piece of research about crypto — maybe it even passes peer review — and this gets reported as a fact in the press, and then used as justification for anti-crypto policymaking. This happens time and time again.

The reason it’s hard to deal with is that crypto doesn’t have a particularly active academic presence, and the academics that engage in peer review often have no experience with crypto, so they have a hard time spotting a fake. Also, most elite academia is basically an anti-meritocratic clown show and most journals are essentially frauds, but that’s a story for another day.

The reason this is so successful, and you keep seeing these awful, fake papers like Mora et al (2018), Griffin and Shams (2020), or anything by De Vries get referenced, is because they provide a valuable resource to the crypto-critical press and policy establishment: truthy sounding research with an academic sheen.

It doesn’t matter that these articles are completely fabricated nonsense with no relationship to the truth. They provide academic air cover to cynics who hate crypto (the Liz Warrens of the world) or to journalists that are often simply too dumb to understand what they’re reading and simply need talking points.

You know how this works. The direction of travel isn’t truth -> analysis -> policy. It’s desired policy outcome -> half-baked analysis -> fake academia.

One great example is the infamous WSJ claim about Hamas using crypto in apparently large amounts, which was immediately weaponized by Elizabeth Warren as the moral and factive justification for a sweeping anti-crypto bill, which came very close to passing. Never mind the fact that all the major chain analysis companies refuted the WSJ analysis, and that the Treasury Undersecretary later confirmed that the WSJ numbers were false.

We only got the truth in that case because we kicked off a gigantic fuss about it. Although it didn’t undo the fact that Sen Warren almost passed extremely punitive anti-crypto rules based on the analysis. And the problem is that it takes a huge amount of work to actually debunk fake academia and fake news; and it’s far easier to produce plausible-sounding falsities that play to the biases of the critics than it is to refute them.

Another great, if even more egregious example, is the cottage industry of fake academics that create anti-Bitcoin mining content. De Vries is a good example. Virtually none of his work is peer reviewed, and he works for the Dutch Central Bank. But because he knows how to place his work in the Commentary (blog) section of academic journals like Joule, he is able to trick journalists into listening to him.

The journalists that he syndicates his takes out to don’t know this of course. They don’t really understand that academic journals are a dime a dozen, and that 99% of academia is basically fake, p-hacked nonsense. They don’t realize that journals have commentary sections with no or little peer review (that’s where virtually all of De Vries work has been “published”). There’s no meaningful difference between me publishing this article on Medium, and De Vries putting his idle thoughts in Joule’s Commentary section.

Yet of course when he sends his “peer reviewed papers” to journalists, they print his claims without a second thought. And then these claims make it into the policy discussion. This is extremely damaging. Right now, the Biden Admin is trying to use fake academia like De Vries to justify virtually eliminating the Bitcoin mining industry in the US, despite abundant evidence that Bitcoin mining is the most benign (if not salubrious) presence on power grids in the U.S.

Griffin and Shams (2020) is debunked garbage

Griffin (and his coauthor Shams) have a simple approach to their crypto-critical “academia”. They make outrageous, extremely negative claims, and then justify them with an obscure, largely proprietary analysis of on-chain data that is extremely hard to parse. Since none of their peers, nor most journalists, actually understand on-chain data, they aren’t able to spot the fact that the empirical support for these claims is basically gobbledygook. And because the anti-crypto claims are generally popular things to believe (“the price of Bitcoin is fake and manipulated upwards by Tether”; “Bitcoin is rampantly used for crime”), their papers tend to be well received, at least in academia and the press.

It’s worth spending some time on Griffin and Shams because they use the exact same strategy there as Griffin does in his new Pig Butchering paper. Outrageous, ludicrously anti crypto claim, followed by a soup of on-chain data which purportedly supports it. Of course, despite his claimed expertise, Griffin is not an expert in on-chain data analysis. He is a tourist who looks at large datasets and finds illusory relationships to justify claims he’s already decided on. What he does is a semi-sophisticated form of p-hacking. With blockchain data, you can make it say virtually anything you want, especially if your analysis boils down to “these flows are BAD, and there are LOT of them.” John abuses this feature of blockchain data more than anyone I’ve ever encountered.

So we will spend some time of Griffin’s Untethered paper to show just how bad his analysis is, especially as we have around six years of data since his sample period to evaluate his claims with.

In the infamous Griffin and Shams paper, Is Bitcoin Really Untethered, the authors consider whether Tether really is just a useful means of accessing crypto markets, or whether Tether is used to systematically inflate the price of bitcoin via unbacked issuance. They call this the ‘push’ hypothesis.

[U]nder the “pushed” hypothesis, Bitfinex prints Tether regardless of the demand from cash investors, and additional supply of Tether can create inflation in the price of Bitcoin that is not due to a genuine capital flow.

They also speculate that under the ‘push’ hypothesis, the Tether team could choose to wind down Tether if Bitcoin crashes and they can no longer handle redemptions.

[I]f cryptocurrency prices crash, the founders essentially have a put option to default on redeeming Tether, or to potentially experience a “hack” or insufficient reserves where by Tether-related dollars disappear

Unsurprisingly, the authors decide that, yes, indeed, Tether is ‘pushed’ rather than ‘pulled’, effectively alleging Tether of running a ponzi and using it to inflate Bitcoin prices.

They say this plainly:

Our results are generally consistent with Tether being printed unbacked and pushed out onto the market, which can have an inflationary effect on asset prices

The bulk of their “quantitative” study refers to the time period from march 2017 to march 2018, a time period when Bitcoin went from around $1000 to $10k (touching $19k on the way) and Tether supply went from a couple hundred million to $2.3b. As you might expect, if you evaluate the hypothesis that Tether inflates Bitcoin prices on the data from the period where everything in crypto went up, you will probably achieve that result. But of course, that’s a preposterously short window, and all of the subsequent data since then throws their result into question.

The actual evidence Griffin and Shams present for their view is:

- During the sample period (2017–18) Bitcoin prices generally increased after Tether prints

- During the sample period, Bitcoin prices cumulatively rose a lot during hours in which Tether had the highest flows

- Tether flows and Bitcoin returns were high at times when Bitcoin was trading at round numbers (i.e. $1000, $2000)

- Bitcoin had negative price performance at the end of the month, indicating that Tether was selling Bitcoin to raise cash to make attestations each month (yes… they actually posited this)

The academics conclude that:

By mapping the blockchains of Bitcoin and Tether, we are able to establish that one large player on Bitfinex uses Tether to purchase large amounts of Bitcoin when prices are falling and following the printing of Tether

And they decide that the ‘push hypothesis’ — aka, unbacked Tether issuance to support the price of Bitcoin, probably by a single large entity — is the right one.

And the cherry on top of this paper, is that it was published in the Journal of Finance, aka the literal most prestigious finance journal in the world.

These outrageous claims were of course repeated uncritically in the press, with Bloomberg reporting breathlessly that a Lone Bitcoin Whale Likely Fueled 2017 Price Surge, among many others. Griffin’s claims also served as the basis for a frivolous $1.4T lawsuit against Tether and Bitfinex. His paper bears more in common with the fabricated Steele Dossier used to undermine Trump’s 2016 election with claims of Russian collusion. This form of academia isn’t just the benign pursuit of truth: it serves as potent fuel for lawfare against Tether, Bitfinex and other market participants; it helps the press delegitimize the crypto space by allowing pundits to claim that the valid appreciation in Bitcoin was due to pure manipulation; and it gives policymakers air cover to harass vital pieces of crypto infrastructure. This isn’t academia: it’s a naked attack on the industry.

The only problem with Griffin and Shams’ analysis is that… it’s completely bunk.

Starting with Griffin and Sham’s evidence. The sample is very small (again, about a 12 month period during a crazy bull market), so of course Bitcoin returns and Tether issuance were correlated. Tether represents the balance sheet of crypto market participants, and balance sheets were obviously climbing during the rally.

The flow hypothesis is explained by virtue of the fact that obviously there’s more on chain settlement when price is volatile. And if you accumulate the hours of the most flows, you will obviously isolate the hours with high returns, and get a high cumulative return figure, especially during 2017–18 when the crypto industry 10x’ed in size.

The round number thesis is just gibberish and can be immediately dismissed.

The end of the month thing is cute, but we know that Tether actually has the cash, so it’s also irrelevant. And at best it’s extremely circumstantial.

In terms of the more conceptual arguments made by the paper, we know they are false, for a few reasons.

1. Tether has processed major redemptions

Since the Griffin and Shams paper, Tether has processed tons of redemptions. The Tether supply drew down by 36% in Oct/Nov 2018 without incident, so it clearly wasn’t unbacked. In May-July 2022, Tether processed $17b in redemptions without issue. If it was unbacked, it wouldn’t have been able to redeem. Large Wall St firms engaged in massive Tether shorts over the years to no avail — they would have had all the incentive in the world to discover that Tether was unbacked and leak that information. They weren’t able to, because it wasn’t unbacked, and always processed redemptions smoothly.

2. Tether has the cash

Tether had an accounting issue where Bitfinex was hacked, and they gave a loan to Bitfinex to cover some of the $850m losses, which was then repaid. This didn’t actually cause any issues with Tether, and they settled with NYAG for the paltry sum of $18.5m. This was a misstep, to be sure, and depending on whom you ask it was either a valid legal transaction, or accounting fraud, but it certainly wasn’t the kind of malfeasance Griffin and Shams were alleging. They weren’t even accidentally right.

After the settlement, Tether agreed to supervision from NYAG for two years with no issues — clear proof that they had the funds (there’s no auditor more compelling than the NYAG itself). More recently, Cantor Fitzgerald CEO Howard Lutnick has taken to loudly proclaiming on TV that Cantor (service provider to Tether) has seen the financials, and they are sound. Tether also continues to release quarterly attestations via audit firm BDO. Tether has the cash, and that’s not disputed by anyone serious.

3. The analysis has never been validated or replicated

At no point since 2018 has the mysterious “lone actor” that Griffin and Shams allege influenced Bitcoin prices with fake Tethers been identified — because there is no such actor. Griffin and Shams, being rank amateurs, simply misread the on-chain data. Tether did not collapse despite two 80% selloffs in the crypto market. Tether did not collapse despite decabillion redemption events or redemptions that took down over a third of supply (let’s see a bank do that). At no point has any actual manipulation by Tether regarding Bitcoin markets been proven. Tether has only become more transparent, more reputable, more surveilled, and better understood.

Griffin and Shams’ research has not been replicated, validated, or proven in any way. It has only been disproven by subsequent events.

4. There is a very simple explanation for this behavior

The core claim by Griffin and Shams is that it’s somehow unusual or evidence of ‘manipulation’ that Tether prints after Bitcoin sells off. However, this is explainable with recourse to simple dip-buying activity — namely, people have cash in fiat, and they want to buy Bitcoin, and go via Tether when the opportunity looks good. So they create Tether with cash, and buy Bitcoin. The other explanation could simply be that participants find a safe haven in stablecoins when they see Bitcoin selling off — or even more directly, the outflow from Bitcoin to Tether is what causes Bitcoin selloffs. So Tether rallying on Bitcoin dips and Bitcoin rallying after Tether creations isn’t particularly surprising or nefarious. Tether represents the balance sheet of market participants and a waystation between fiat and Bitcoin.

5. Tether clearly does not support Bitcoin prices

Since the short sample period in the Griffin and Shams paper (when everything was going up anyway), there have been plenty of occasions in which Tether supply and the price of Bitcoin have gone in opposite directions. This undermines the core G&S claim — that printing unbacked Tethers was sufficient to buoy the price of Bitcoin. If it was so easy to support BTCUSD by printing Tether, why did Bitcoin sell off from $19k to $3k in 2018–19? Why did Bitcoin sell off ever? Why have the price of Bitcoin and the supply of Tether gone in different directions on many occasions? Why didn’t the lone actor just print to infinity? If the lone actor was printing with unbacked Tethers, why didn’t Tether collapse when Bitcoin did? G&S don’t have answers to these questions.

Let’s look at a few periods in Bitcoin’s history to show how asinine the view is that Tether has any role in supporting Bitcoin prices.

From Jan 2018 to Oct 2018, Tether supply grew from $2b to $2.8b. In that period, Bitcoin fell from $13.5k to $6.5k. Where was the mysterious Tether whale supporting the Bitcoin price?

BTCUSD vs Tether supply, 2017–18

BTCUSD vs Tether supply, 2017–18

Tether began November 2021 at $73b and was at that exact same level in March 2023. Over that period, Bitcoin fell from $59k to $24k. Where was the mysterious price-supporting Tether whale?

BTCUSD vs Tether supply, 2020–23

BTCUSD vs Tether supply, 2020–23

Obviously, these are just price observations rather than fancy statistical regressions, but you don’t actually need advanced econometrics to understand the facts here. (Given that I have a Masters in econometrics, I could put this in regression format and publish a fake academic paper. But any idiot with STATA can ‘prove’ anything at all with a regression. The important thing is that the data matches intuition and financial theory.) The fact is, Bitcoin has sold off plenty of times when Tether is rallying. Griffin and Shams did their analysis when both Bitcoin and Tether were going up together (as everything in crypto was parabolic at that time), and so it was easy for them to “prove” that their movements were correlated. However, we have six additional years of evidence since them showing that they were simply wrong.

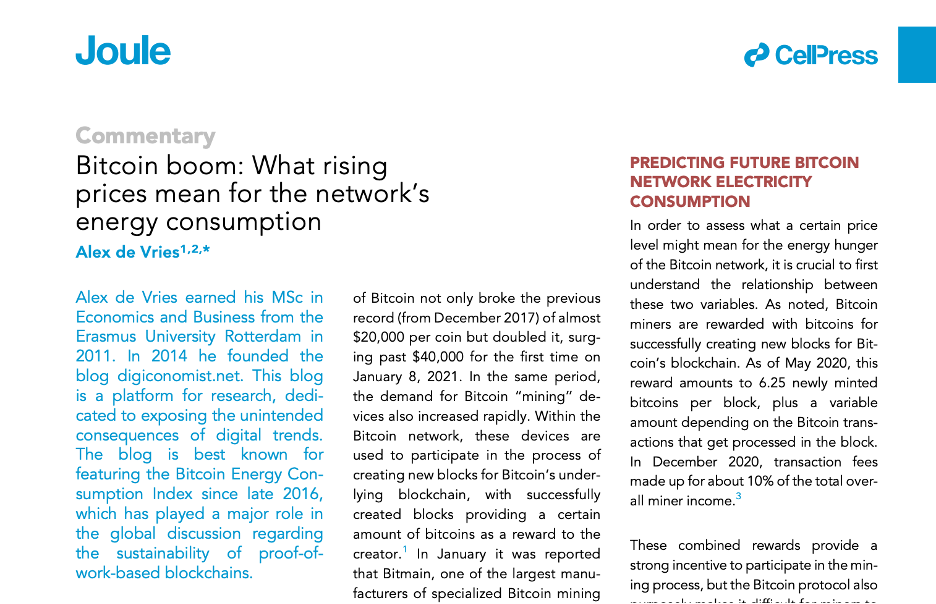

6. Other academics have convincingly pushed back

Most notably, Viswanath-Natraj and Lyons evaluated Griffin and Shams and found that their analysis was, basically unsound. First of all, they find no actual evidence that Tether issuance was followed in the near or medium term by Bitcoin or ETH appreciation, so there’s that.

Graphic from What Keeps Stablecoins Stable

Graphic from What Keeps Stablecoins Stable

They explain stablecoin issuance not with recourse to a mystery whale printing Tethers to buoy the Bitcoin market, but with a much more straightforward explanation: Tethers are printed when Tether trades at a premium, which can appear during bullish phases, or when the market is in safe haven mode. Everyone who understands stablecoins knows this. Of course, Griffin and Shams make scarce mention of market makers, arbitrageurs, authorized participants, or these more precise mechanics of Tether creation and redemption in their paper. Because they are ignorant and unfit to have an opinion on the topic. For an actual paper explaining the fundamentals of stablecoin issuance and the factors that drive it, consider Viswanath-Natraj and Lyons.

G&S’ peers haven’t exactly come to their defense. For such a blockbuster paper in the Journal of Finance, you might expect it to have been corroborated at some point. But this didn’t happen. No one has proven Tether-Bitcoin manipulation — despite billions of dollars of Tether shorts from sophisticated hedge funds, who would have loved to prove such a thing. No one has identified the mysterious “lone actor” that Griffin and Shams think manipulated Bitcoin with Tether prints. It appears to have been a chimera that they dreamed up, or an misunderstanding how OTC desks work. No one, not the NYAG or any other court, has proven that Tether “printed unbacked Tethers” for any reason whatsoever. The NYAG found that Tether wasn’t truthful about their loan to Bitfinex, but they didn’t find the kind of wrongdoing that Griffin and Shams allege — and they found nothing thereafter, despite an inordinate amount of political pressure of Tether. Tether was emblematic of the crypto industry, and it has been the primary target of attacks from hedge funds short crypto, the press, academia, and the policy and law enforcement establishment. The fact that all of these entities looked as hard as they could, for the last decade or so, and came up empty, is more evidence that Griffin and Shams were chasing a boogieman.

The simple explanation here is that Griffin and Shams just have an anti-crypto animus, and decided to make up a fantasy which they veiled in fancy math to explain why Bitcoin was going up so much, with Tether the culprit. In the mind of the crypto critic, the success of Bitcoin can never be due to real factors, like actual, real-world demand. It has to be due to fakery and manipulation. This is why the Tether truther brainworm is so prevalent. It convinced an entire generation of investors that Bitcoin was only going up because of “fake Tethers”, and not because Bitcoiners were actually right. The critic and the hater can never accept that they are wrong. If the market proves them wrong it is because there is a crime being committed, a conspiracy, some kind of trickery. They can’t admit they were just plain wrong, and millions of people worldwide simply want what Bitcoin is selling. Untethered is the most successful piece of literature in this genre of Bitcoin Cope. Unfortunately for G&S, hindsight has showed us that their analysis was unsound. This hasn’t stopped them though.

John Griffin uses his academic platform for self- promotion and profiteering

John Griffin’s academic poverty is matched only by his own arrogance. Just read this simpering story in Fortune about him from 2023 — if you can get through it. The article describes him as a “6-foot-2 former high school football star [who] views himself as a crusader for good, a moral sleuth who, as he tells Fortune, “looks to expose financial evil, to shed light on the world and expose dark things in the markets.’ ” Definitely a dispassionate and truth-seeking academic right there.

And the very fact that he reached out to Fortune to get a sycophantic profile written (that’s how these things work, journalists don’t just randomly profile mid-tier academics) is remarkable. He probably knows that his 2020 Untethered paper is bunk given all the evidence we have received since then, but he actually dug his heels in and had the nerve to take a victory lap. In the Fortune piece he claims that the utterly benign and unremarkable price action in 2023 is “very suspicious. The same mechanism we saw in 2017 could be at play now in the still unreal Bitcoin market.” Like a Sasquatch chaser who got a writeup in local news once for allegedly spotting the beast decades ago, Griffin has kept at it and now sees his mythical manipulator around every corner.

He continues to be deliberately blind to the reality of Tether, maintaining over and over again that Tether is used only as a lubricant for crypto speculation. In the Fortune article he claims that “Bitcoin and Tether aren’t used for buying things like cars and pizzas, they’re used for buying other coins. So in that closed system, a relatively small amount of manipulated buying, spurred by creating new coins from nothing, can cause an outsize increase in the Bitcoin price.”

Of course, this is false. Tether is widely used in emerging markets like Argentina, Nigeria, Turkey and many others as a digital dollar equivalent. Right now, Nigeria is experiencing a panic of sorts as they grapple with crypto-dollarization driven mainly by citizens engaging in Tether-powered currency substitution. These individuals use Tether as a savings device, a means to access crypto yields, a tool for remittances, payroll, b2b transfers, cross border trade invoicing, and other conventional uses. Griffin refuses to acknowledge these facts, because they undermine his story that Tether is created only to jack up crypto prices.

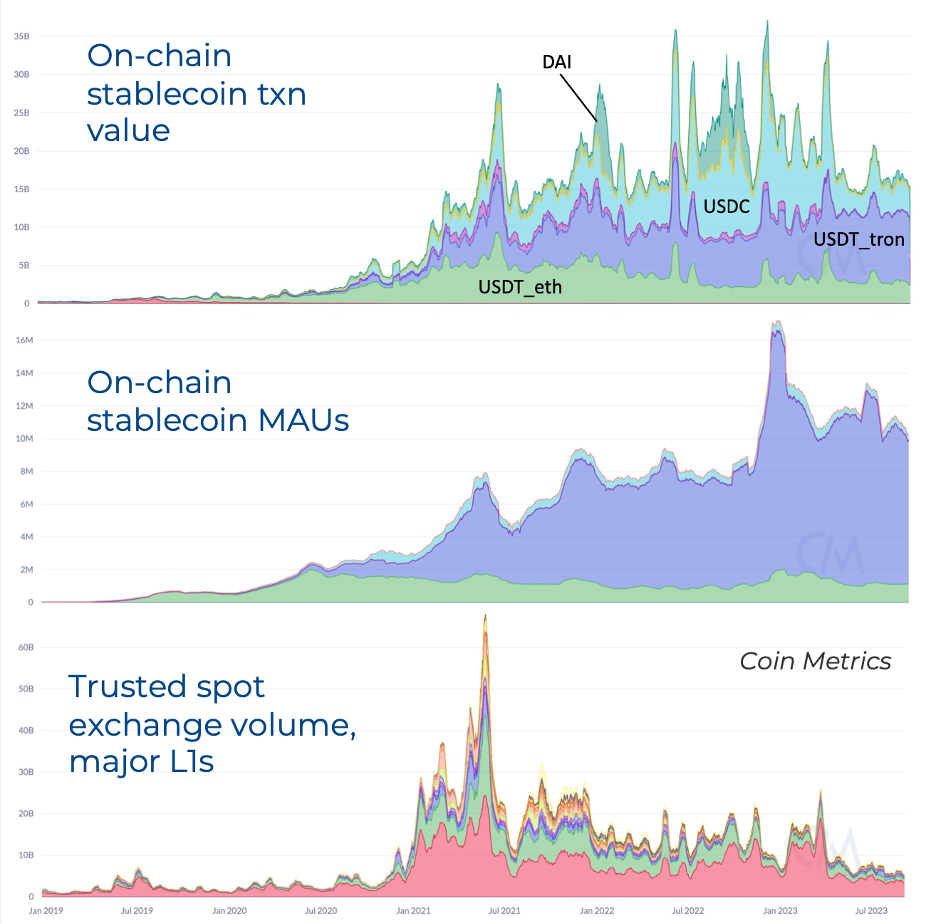

In fact, the data clearly shows that Tether (and other stablecoin) usage has increasingly become de-correlated with liquidity and trading dynamics in crypto. To be sure, stablecoins still enjoy an important role as crypto collateral, margin, and as a settlement rails between traders and exchanges. But in the data, we see increasing use of stables for non-crypto activities, too.

Stablecoin and exchange metrics, 2019–2023

Stablecoin and exchange metrics, 2019–2023

Griffin would be surprised to learn that stablecoin usage, particularly Tether, grew throughout the bear market both in terms of the dollar value of transactions, and monthly active wallets. This was while every other metric in crypto declined, like price, volume, and so on. If stablecoins had solely been a speculative instrument used to post collateral on exchanges or move funds back and forth, their use would have declined with the broader crypto selloff. But that didn’t happen. They found real product market fit as digital dollar equivalents, particularly in EM. Much of this usage has nothing to do with the crypto economy at all. But Griffin refuses to engage with this reality, either out of his sheer incapability, or because he’s too stubborn to acknowledge that Tether actually has a huge amount of real-world traction.

Because Griffin refuses to engage with today’s stablecoins reality — which is that they are actually quite untethered from crypto market cycles, and have achieved meaningful usage in the real world — he remains completely ignorant about his own subject, and unfit to write about it.

What’s more, Griffin uses his papers as ad space for a company he owns, Integra. I don’t know what the University of Texas code of ethics is regarding this approach, but it’s sketchy at best. On the very first page of his Pig Butchering paper he loudly advertises Integra:

We further thank Integra FEC for use of their bulk tracing tools and for substantial crypto-research support. Griffin is an owner of Integra FEC and Integra Research Group, which engage in financial consulting, research, and recovery on a variety of issues related to the investigation of financial fraud.

Yes, thank you Integra, company that I happen to own! We couldn’t have done it without you!

As to what he’s using Integra for, its not very inspiring. In the paper he says: “We use a variant of the Ether, ERC-20 token, and Bitcoin bulk-tracing tool developed by Integra FEC to simultaneously follow multiple paths.”

This is amusing to me because there are a dozen different software tools and analytics providers that can do this. “Simultaneously following multiple paths” is not exactly a challenging problem. But of course, only Griffin’s Integra was fit for the job. Can’t have him shouting out Alchemy or any of the sophisticated chain analysis software products that have benefited from hundreds of millions in R&D. No, it was Integra that was conveniently uniquely positioned to solve this problem for Griffin. Thanks, Integra.

And lastly, Griffin writes in an emotional and grandiose manner, which is completely unbecoming for what should be sober academia. He clearly thinks he’s on a divine mission to root out evil in crypto, and he uses these papers as a pulpit to preach as much as to inform. It’s honestly embarrassing. Here’s a few choice passages:

From the Pig Butchering paper:

Our findings highlight how the “reputable” crypto industry provides the common gateways and exit points for massive amounts of criminal capital flows. We hope these findings will help shed light on and ultimately stop these heinous crimes.

He self-importantly dedicates his paper to “all pig butchering victims, those defrauded and those enslaved, and especially the victim who gave us the impetus to write this paper.” I’m sure those enslaved are grateful for John Griffin.

As we will cover in the next section, he’s extremely aggressive towards the crypto industry, using his unsupported assertions to harass major players in the space. For instance, even though his $75b figure is extremely dubious, he straightforwardly asserts the following with no caveats:

[L]arge crypto exchanges like Binance, Huobi, OKX act as exit points for $75.3 billion in criminal proceeds.

And he ends the paper with this absolute clanger:

[O]ur analysis shows that the “legitimate” crypto space commonly serves as the entry and exit point to the illegitimate space and in so is facilitating the cheap and easy flow of funds that is the lifeblood enabling both pig butchering and modern-day slavery.

These are absolutely wild, possibly slanderous allegations, especially when he singles out specific firms like Binance, Huobi, OKX, and Tether. They are especially startling when juxtaposed against the utter poverty of his analysis itself, which we will cover in the next section.

On Pig Butchering, Griffin doesn’t know better than Chainalysis

Griffin’s latest contribution to the academic literature is a paper written with Kevin Mei entitled “How Do Crypto Flows Finance Slavery? The Economics of Pig Butchering”. The title is indicative: Griffin thinks that crypto flows facilitate a huge number ($75b worth of these in his estimate) of romance scams (what he calls “pig butchering”), and what’s more, they are carried out by a vast network of slaves, mainly in South East Asia.

As is always the case with this academia truth laundering, the press has already reported uncritically on his numbers, even though the paper is an un-peer reviewed preprint. It’s only a matter of time between Senator Warren uses this talking point to further harass the crypto space.

Griffin holds crypto culpable for both romance scams and this apparent slave network. He doesn’t contemplate in the paper anything like other means of payment. Reading the paper, you’d think that crypto invented both slavery and scams.

Before we even start on his numbers, it’s absurd that he appears to hold crypto responsible for these alleged slave networks, implying that they only exist because of crypto. He says the following:

Though varied in nature, the origin of these scams is often even darker, as the manpower powering the communications is often enslaved in compounds thought to hold 220,000 victims in Southeast Asia. This paper examines how these criminal organizations are financed through cryptocurrencies.

In support of that 220k figure, he cites a UN report which says “Credible sources indicate that at least 120,000 people across Myanmar may be held in situations where they are forced to carry out online scams, while credible estimates in Cambodia have similarly indicated at least 100,000 people forcibly involved in online scams.” The UN is considerably softer in their language than Griffin, and they don’t actually cite any third party for their estimate, just saying that the 220k figure comes from “information on file with OHCHR”. I suppose you can just blindly trust the UN’s assertion. But it remains the case that the source for this eye-popping figure is “just trust me bro”.

It’s also worth noting that, unlike Griffin’s sly attempt to place the blame for all of these 220k potentially indentured laborers on crypto (even the UN report is coy in terms of calling it “slavery”, unlike Griffin), the UN document mentions several different financing mechanisms for such scams. They clearly do not place the entire blame on crypto — and no reasonable person would, because romance scams long predate the existence of crypto. Digital fiat transmission methods have existed for well over 100 years.

One last amusing note is that the very UN report that Griffin cites, itself cites an estimate of crypto scams (in the aggregate) that’s far, far lower than Griffin’s own estimate of flows deriving from romance scams (by a factor of ten). So Griffin’s own estimate is contradicted by a paper he is relying on for a key claim he is making.

Griffin and Mei’s major quantitative approach is the following: they sum up flows from addresses that they attribute to romance scammers, and determine that they represent “$75.3 billion in criminal proceeds” in the 2020 to 2024 time period. They go as far as to say that if you apply a looser clustering heuristic, the figure could be as high as $237 billion. This should be a clue that something is wrong. They’re twiddling a dial that represents the looseness of the heuristic they’re using to determine which wallets they think belong to scammers, and getting results that vary by hundreds of billions of dollars.

The base of their analysis is wallets collected from “online message boards, dedicated crypto-scam reporting websites, and first-hand personal accounts” reported to be associated with romance scammers. They “apply screens through information collected on Etherscan to remove any addresses that are likely unrelated to pig butchering.” Ah, that’s settled then. They looked at Etherscan, so that’s all the false positives removed then. Good job.

They then take those addresses and use “proprietary criteria” developed by Griffin’s company Integra (thanks, Integra!) to determine if flows are attributable to romance scammers. Some of the criteria they mention are:

- A completely arbitrary 5-hop rule

- The coins reach an exchange

- The coins reach a wallet that they think aren’t related to romance scams

Notwithstanding the obvious issue in both advertising his own company in the paper, and relying on an unreplicable black box methodology invented by said company, their disclosed criteria are ludicrous. Coins can go anywhere in five hops. It’s very likely in this case that they are being comingled with flows to brokers.

Taylor Monahan, one of the premier experts on crypto fraud and scams, says that Griffin’s numbers are “a few orders of magnitude off,” noting that the authors have “clearly double counted certain flows and have misidentified OTC / money broker addresses as scammer-controlled.” This second mistake is exactly the one the WSJ made in their erroneously high estimates of Hamas crypto wallets.

In terms of actual estimates, Chainalysis helpfully published in their 2024 Crypto Crime Report estimates of scam volume. Chainalysis is a multi-billion-dollar company with hundreds of employees dedicated to accurately characterizing entities and illicit flows. Their objective is not to minimize illicit flows (nor to exaggerate them) but rather to be as faithful as possible. Needless to say, they have massively more resources than two lone academics, and they face stiff competition from other chain analysis providers and hence have an economic reason to get these things right (unlike the academics, who are clearly motivated by an anti-crypto animus and whose motive appears to be to embellish the data to paint crypto in a negative light).

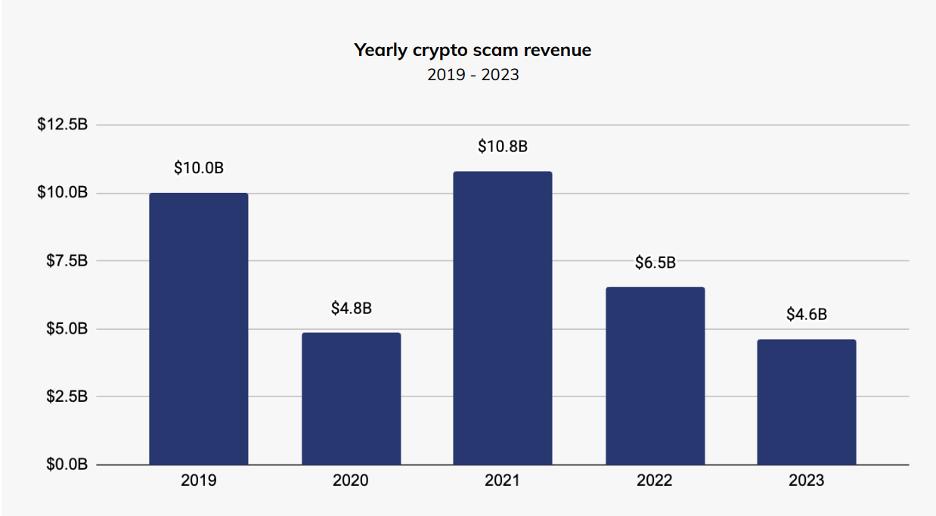

Chainalysis report that “scamming revenues globally have been trending down since 2021”. They do admit that romance scam activity is trending up, and that tracking these scams on the blockchain can be difficult. As with all on-chain tracking of real-world flows, there’s a significant amount of ambiguity, and anyone that doesn’t acknowledge this should be treated with suspicion.

Chainalysis, 2024 Crypto Crime Report

Chainalysis, 2024 Crypto Crime Report

Chainalysis doesn’t specifically break out romance scam flow volume in their report, but even for the aggregate scam category (which includes other categories like charity scams, giveaway scams, impersonation scams, investment scams, NFT scams, phishing and extortion, and rug pulls), the total aggregate figure since 2020 is $26b.

Again, romance scams are a subset of this, so the $75b to $237b range Griffin and Mei land on is wildly overestimated, likely by a full order of magnitude. Chainalysis in a tweet refer to only $1b in flows attributable to approval phishing and romance scams since 2021 (although this may only be a subset of the romance scam category). I would invite the blockchain analysis firms to publish their own estimates of romance scams, as they did when the WSJ published their excessively high estimates regarding Hamas-related flows.

More fundamentally, blaming a financial settlement network for romance scams, or for slavery, is just asinine. If crypto didn’t exist, do you think scammers would just stop? Clearly, they simply use other digital payment networks. It’s not like the world is going to lose the ability to transact at a distance. Griffin might say that there’s something unique about crypto that makes it a great conduit for fraud or crime, but the very fact that these transactions are so traceable and leave a permanent record (and in the case of stablecoins, can be frozen by the issuer) is why you don’t want to use crypto for crime. Indeed, law enforcement officials with crypto expertise frequently say that they would prefer that illicit activities be conducted on crypto rails as opposed to using wire transfers through a network of banks. Just recently, OKX and Tether were able to freeze $225m USDT associated with romance scams. This speaks to the usefulness of stablecoins for law enforcement purposes. Try that with cash, or try sending a subpoena to a cluster of international banks, and see how fast you can interdict funds.

For sure, there are some genres of fraud and harm that are specific to crypto itself, like phishing scams that target funds held in browser wallets. But romance scams are a kind of fraud that can be perpetrated via many types of payment networks, whether it’s p2p apps like Venmo and Zelle, or wire transfers or the physical delivery of cash. If Griffin wants to hold crypto particularly culpable for romance scams, he needs to establish that there’s something unique about crypto that makes it particularly bad here. But beyond his erroneous flow estimate, there’s just nothing there.

John Griffin abuses blockchain analysis to support a conclusion he has already decided on

In both Untethered and Pig Butchering, Griffin does the exact same thing: he looks at masses of blockchain data, declares that certain nodes are bad (in Untethered, it’s an evil manipulator printing Tethers and buying Bitcoin, in Pig Butchering it’s the scammers themselves). And then he uses his super proprietary Integra-assisted advanced blockchain analysis to connected those clusters of addresses to many, many more, and he derives eye-popping flow data from that. Then out of this toxic stew he is able to come up with outrageous figures and conclusions; in the case of Untethered, it’s that a single actor was responsible for printing Tether and manipulating upwards the price of Bitcoin; in Pig Butchering, it’s that these scammers have apparently harvested $75.3b from their victims.

The problem with this is of course that the blockchain is a massive network of interconnected nodes, and if you get even one tiny detail wrong, such as mistaking a market maker, OTC desk, or exchange for an individual user, you will get a massively overestimated figure. And this is what he’s doing. He’s being extremely careless with false positives and badly polluting his dataset. This is why we generally leave this stuff to the professionals, because blockchain analysis is very hard, and without an extremely high level of entity characterization, these blind estimates are completely worthless. And Griffin definitely makes this mistake!

By including tons of false positives in his dataset, Griffin erroneously decides that Bitcoin is manipulated by a single entity (which no one has ever confirmed), and he finds an estimate for pig butchering flows that are many times greater than the state of the art estimate from Chainalysis. But this isn’t a problem for Griffin, because he feels that he’s on a God-given mission to root out the evil of crypto. So landing on an extremely inflated figure that makes crypto look extra bad is just fine to him! It’s all in service of a just cause, after all.

This is interestingly the exact same problem that plagued the misleading WSJ coverage of the Hamas crypto flows. The WSJ was relying on a naïve analysis of addresses published by Israeli intelligence and simply added up all the flows they could find relating to them, without ever stopping to wonder who those addresses belonged to. As Chainalysis and Elliptic later confirmed in their corrections, some of these addresses were brokers that had many types of flows, both licit and illicit. So naively adding up all those flows and ascribing them all to Hamas was totally wrong. This was later confirmed by the Treasury Undersecretary Nelson in sworn testimony in Congress.

At the end of the day, as I tried to point out during the WSJ/Hamas affair, there is considerable ambiguity when you try and ascribe real-world flows to blockchain data. It’s extremely easy to overestimate flows from clusters of addresses, especially when you are using naive heuristics. And yet time and again we see academics pollute the popular and policy discourse by tying [bad thing] to these inflated flows. A toxic brew of poor or lacking peer review, gullible journalists, and hostile policymakers means that these exaggerated or false claims tend to have a huge amount of staying power, and are often used to justify bad and hostile policy versus the industry.

The curse of legibility

If you consider the WSJ/Hamas affair, Griffin and Shams, or Pig Butchering, the problem is the same. Blockchains are the most legible financial databases in history. Any member of the public can read the entire history of transactions of anyone that has ever used a blockchain — although they don’t necessarily have the overlay between entities and addresses. No other financial database is as transparent, and this is crypto’s curse. Any third party can simply look at on-chain data and tease out sinister conspiracies based on their interpretation of the data. If JPM’s correspondent bank database was public, I’m sure plenty of academics and internet sleuths would be poring over that too.

So crypto is held to a far higher standard than any other transactional medium, especially when illicit or questionable activity is concerned. Because the moment wrongdoers are identified on chain, all of their flows can be derived (and over-extrapolated, as is the case here). Even though the scammers have used many different transactional media over the years (and this stuff dates back decades), the crypto transactions get the most attention, quite simply because bank records aren’t available to third parties. So crypto takes all of the blame, because it’s legible, and other transactional tools are not.

But what’s interesting is that the fairly sophisticated reporting apparatus that has emerged in crypto, and its intersection with law enforcement, has meaningfully impaired the ability of these scammers to operate. Hamas stopped soliciting donations after their donors were targeted. The Tether/OKX seizure of $225m in USDT associated with romance scams was quite material and would have caused the scammers to think twice about using stablecoins. Rooting out these scams and freezing and seizing them is getting more practical by the day, as law enforcement gets more sophisticated about blockchain analysis.

Thanks to Taylor Monahan for her feedback on this article.